OfficeMax 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

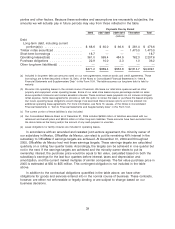

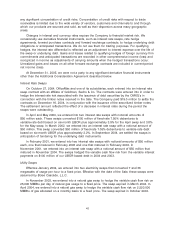

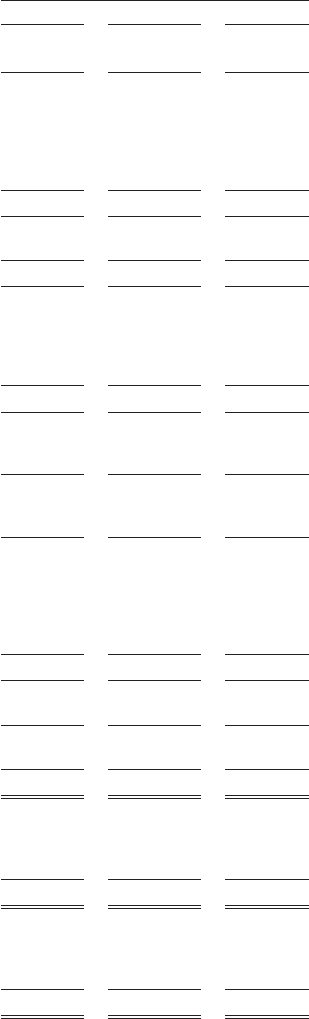

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

OfficeMax Incorporated and Subsidiaries

Consolidated Statements of Income (Loss)

Year Ended December 31

2005 2004 2003

(thousands, except per-share amounts)

Sales ............................................... $9,157,660 $ 13,270,196 $ 8,245,098

Costs and expenses

Materials, labor and other operating expenses .................... 6,923,911 10,361,090 6,624,575

Depreciation, amortization and cost of company timber harvested ........ 151,145 354,982 307,849

Selling and distribution expenses ............................. 1,730,231 1,948,106 948,955

General and administrative expenses .......................... 288,636 304,658 158,786

Other (income) expense, net ................................ 59,505 (83,740) 35,786

9,153,428 12,885,096 8,075,951

Gain on sale of forest products assets .......................... — 280,558 —

Equity in net income of affiliates ............................ 5,460 6,311 8,822

Income from operations .................................. 9,692 671,969 177,969

Debt retirement expense .................................. (14,391) (137,137) —

Interest expense ........................................ (128,504) (151,939) (132,545)

Interest income ........................................ 97,272 14,093 1,186

Timber notes securitization ................................. — (19,000) —

Other, net ............................................ (1,685) 1,456 2,630

(47,308) (292,527) (128,729)

Income (loss) from continuing operations before income taxes, minority

interest and cumulative effect of accounting changes ............ (37,616) 379,442 49,240

Income tax provision ..................................... (1,226) (142,291) (13,860)

Income (loss) from continuing operations before minority interest and

cumulative effect of accounting changes ..................... (38,842) 237,151 35,380

Minority interest, net of income tax ............................ (2,370) (3,026) —

Income (loss) from continuing operations before cumulative effect of

accounting changes ................................... (41,212) 234,125 35,380

Discontinued operations

Operating loss ....................................... (24,416) (32,095) (29,943)

Write-down of assets ................................... (28,243) (67,841) —

Income tax benefit ..................................... 20,109 38,869 11,638

Loss from discontinued operations .......................... (32,550) (61,067) (18,305)

Income (loss) before cumulative effect of accounting changes ........ (73,762) 173,058 17,075

Cumulative effect of accounting changes, net of income tax ............ — — (8,803)

Net income (loss) ...................................... (73,762) 173,058 8,272

Preferred dividends ...................................... (4,378) (11,917) (13,061)

Net income (loss) applicable to common shareholders ............. $ (78,140) $ 161,141 $ (4,789)

Basic income (loss) per common share

Continuing operations ................................... $ (0.58) $ 2.55 $ 0.37

Discontinued operations ................................. (0.41) (0.70) (0.30)

Cumulative effect of accounting changes, net of income tax .......... — — (0.15)

Basic income (loss) per common share ....................... $ (0.99) $ 1.85 $ (0.08)

Diluted income (loss) per common share

Continuing operations ................................... $ (0.58) $ 2.44 $ 0.37

Discontinued operations ................................. (0.41) (0.67) (0.30)

Cumulative effect of accounting changes, net of income tax .......... — — (0.15)

Diluted income (loss) per common share ...................... $ (0.99) 1.77 $ (0.08)

See accompanying notes to consolidated financial statements.

47