OfficeMax 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

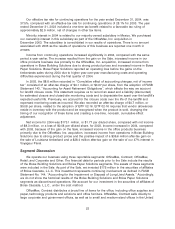

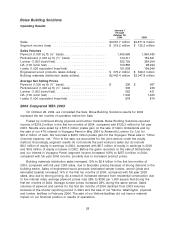

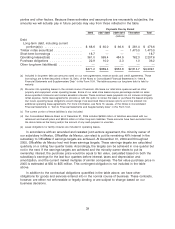

Boise Paper Solutions

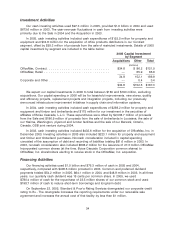

Operating Results

January 1

through

October 28,

2004 2003

Sales .......................................... $1,670.4 million $1,852.6 million

Segment income (loss) ............................. $ 38.8 million $ (13.9) million

(short tons)

Sales Volumes

Uncoated free sheet ................................ 1,249,000 1,396,000

Containerboard ................................... 537,000 650,000

Newsprint ....................................... 349,000 416,000

Other .......................................... 138,000 146,000

2,273,000 2,608,000

(per short ton)

Average Net Selling Prices

Uncoated free sheet ................................ $ 718 $ 721

Containerboard ................................... 365 337

Newsprint ....................................... 434 397

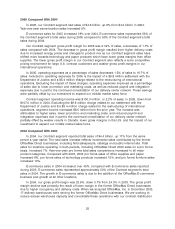

2004 Compared With 2003

On October 29, 2004, we completed the Sale. Boise Paper Solutions results for 2004 represent

the ten months of operation before the Sale.

Boise Paper Solutions reported income of $38.8 million for the first ten months of 2004,

compared with a loss of $13.9 million for full year 2003. Results in 2004 were aided by a pretax

gain of $59.9 million on the sale in March of approximately 79,000 acres of timberland in western

Louisiana for $84 million. We recorded the $59.9 million pretax gain in ‘‘Other (income) expense,

net.’’ Excluding this gain, the segment lost $21.1 million in the first ten months of 2004. Results in

2004, excluding the gain, compare unfavorably with 2003 results because of less sales volume as a

result of the shorter reporting period in 2004, $2.8 million of costs and/or lost income due to timber

and mill damage and lost production at our Alabama paper mill related to disruption from

hurricanes in September, increased unit manufacturing costs and operating difficulties due to

adverse weather conditions and other production issues in the first quarter of 2004. Unit

manufacturing costs increased 3% during the ten-month period in 2004, compared with full year

2003, primarily due to increased fiber costs.

Although markets strengthened in 2004, sales for the first ten months of the year were

$1.7 billion, compared with $1.9 billion for full year 2003. Total sales volume for the first ten months

of 2004 was 13% less than sales volume for full year 2003. Sales and sales volumes declined

because of the shorter reporting period in 2004. Weighted average paper prices increased 3%.

Average newsprint and containerboard prices increased $37 per ton and $28 per ton, respectively,

compared with prices in 2003, while the average price for uncoated free sheet, our largest paper

grade, was $3 less per ton than in 2003. We took 57,000 tons of market-related downtime during

the first ten months of 2004, compared with 197,000 tons during full year 2003. The decrease in

curtailment in 2004 reflects growing market demand and a 2% increase in the amount of office

29