OfficeMax 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Voyageur Panel

In May 2004, the Company sold its 47 percent joint venture interest in Voyageur Panel, which

owned and operated an oriented strand board plant in Barwick, Ontario, Canada, to Ainsworth

Lumber Co. Ltd. for $91.2 million in cash. The Company recognized a $46.5 million pretax gain

($28.4 million after tax) on the transaction, which is included in other (income) expense, net in the

Consolidated Statement of Income (Loss) for 2004, and reported in the Boise Building Solutions

segment.

Prior to the sale, the Company accounted for this joint venture interest under the equity

method. Accordingly, segment results do not include the sales of Voyageur Panel, but do include

$6.3 million and $8.7 million of equity in earnings from this investment for 2004 and 2003,

respectively.

Under the terms of an agreement with Voyageur Panel, the Company operated the plant and

marketed its product in exchange for a management fee and sales commissions. During 2004 and

2003, Voyageur Panel paid $2.1 million and $3.7 million, respectively, in sales commissions to the

Company. In addition, Voyager Panel paid management fees to the Company of $0.4 million in

2004 and $1.1 million in 2003.

13. Goodwill and Intangible Assets

Goodwill

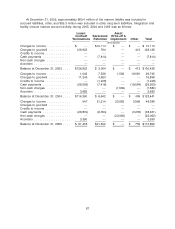

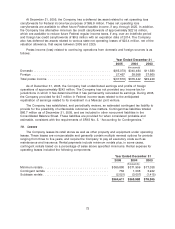

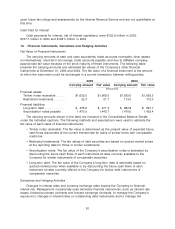

Changes in the carrying amount of goodwill by segment are as follows:

Boise

OfficeMax, OfficeMax, Building

Contract Retail Solutions Total

(thousands)

Balance at December 31, 2003 ........... $487,997 $ 607,656 $ 11,639 $ 1,107,292

Effect of foreign currency translation ....... 14,116 — — 14,116

Purchase price adjustments ............. 3,803 51,744 — 55,547

Sale of assets ....................... — — (11,639) (11,639)

Balance at December 31, 2004 ........... 505,916 659,400 — 1,165,316

Effect of foreign currency translation ....... (4,188) — — (4,188)

Businesses acquired ................... 22,461 — — 22,461

Purchase price adjustments ............. (652) 35,263 — 34,611

Balance at December 31, 2005 ........... $523,537 $694,663 $ — $1,218,200

The initial OfficeMax, Inc. purchase price allocation was revised during 2004 as additional

information related to the fair values of the assets acquired and liabilities assumed became

available. These revisions were primarily related to accruals for estimated costs associated with

retail store closures and the consolidation of the Company’s distribution center network and

customer service centers, and adjustments to the initial estimates of the fair value of assets

acquired and liabilities assumed. During 2005, the Company filed the remaining tax returns related

to the pre-acquisition operations of OfficeMax, Inc. and adjusted goodwill to reflect the true-up of

deferred tax assets and liabilities related to the acquired net assets.

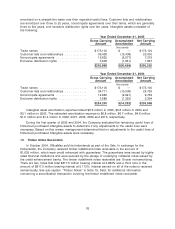

Acquired Intangible Assets

Intangible assets represent the values assigned to trade names, customer lists and

relationships, noncompete agreements and exclusive distribution rights of businesses acquired. The

trade name assets have an indefinite life and are not amortized. All other intangible assets are

75