OfficeMax 2005 Annual Report Download - page 25

Download and view the complete annual report

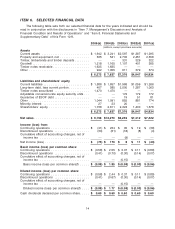

Please find page 25 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2004, ‘‘Other (income) expense, net’’ was $83.8 million of income and included the

$46.5 million pretax gain on the sale of Voyageur Panel, a $59.9 million pretax gain on the sale of

approximately 79,000 acres of timberland in western Louisiana and a $15.1 million pretax gain on

sale of timberlands, mostly in Idaho, offset by approximately $18.9 million of costs related to the

Sale, $8.9 million of integration and facility closure costs, and $7.1 million of costs related to the

sale of our Yakima, Washington plywood and lumber facilities (see Note 7, Other (Income) Expense,

Net, of the Notes to Consolidated Financial Statements in ‘‘Item 8. Financial Statements and

Supplementary Data’’ of this Form 10-K for additional information related to the components of

Other (Income) Expense, net).

In 2004, we recorded a $280.6 million gain on the Sale. An additional $180 million gain on the

Sale was deferred as a result of our continuing involvement with Boise Cascade L.L.C. We will

recognize this gain as we reduce our investment in affiliates of Boise Cascade L.L.C.

In 2005, equity in net income of affiliates was $5.5 million compared with $6.3 million in 2004.

The year-over-year variance was due to equity in earnings of Voyageur Panel, which was included

in the results for the first half of 2004. We sold our 47% interest in Voyageur Panel to Ainsworth

Lumber Co. Ltd., for $91.2 million in cash in May 2004.

During 2005 and 2004, we incurred costs related to the early buyback of debt of approximately

$14.4 million and $137.1 million, respectively.

Interest expense was $128.5 million and $151.9 million for the years ended December 31, 2005

and 2004, respectively. The decrease in interest expense was due to reduced debt levels in 2005, a

result of debt repurchases and retirements funded with proceeds from the Sale. In 2005, interest

expense included approximately $81.5 million of interest recognized as a result of consolidating the

issuers of $1.5 billion of timber securitization notes in the Company’s financial statements. The

interest expense associated with the timber securitization notes is offset by interest income of

$82.3 million earned on the timber notes receivable. The interest income on the timber notes

receivable is included in interest income and is not netted against the related interest expense in

our Consolidated Statement of Income (Loss).

Interest income was $97.3 million in 2005 compared with $14.1 million in 2004. Interest income

includes interest earned on the timber notes receivable. The increase in interest income is primarily

due to the inclusion of a full year of interest earned on the timber notes receivable in 2005

compared to only two months in 2004, with the remainder due to the increase in cash and

short-term investments following the Sale.

We recognized a tax provision of $1.2 million on our loss from continuing operations of

$37.6 million in 2005, or an effective rate of (3.3)%, compared with an effective tax rate applicable

to continuing operations of 37.5% for 2004. Changes in estimated tax rates are due to the sensitivity

of the rates to changing income levels and the mix of domestic and foreign sources of income as

well as the increase in the valuation allowance for certain state net operating losses and the

non-deductible nature of certain severance costs and the legal settlement recorded during 2005.

Minority interest expense, net of income tax was $2.4 million in 2005 compared to $3.0 million

in 2004.

Loss from continuing operations for 2005 was $41.2 million or $0.58 per diluted share,

compared with income from continuing operations of $234.1 million, or $2.44 per diluted share in

2004. Including the loss from discontinued operations, the net loss for 2005 was $73.8 million, or

$0.99 per diluted share, compared with net income of $173.1 million, or $1.77 per diluted share in

2004. In 2005, net loss included a $28.2 million pretax charge for the write-down of impaired assets

at our Elma, Washington manufacturing facility, which is accounted for as a discontinued operation.

21