OfficeMax 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2005, the Company has a deferred tax asset related to net operating loss

carryforwards for Federal income tax purposes of $65.9 million. These net operating loss

carryforwards are available to offset future Federal taxable income, if any, through 2025. In addition,

the Company has alternative minimum tax credit carryforwards of approximately $221.6 million,

which are available to reduce future Federal regular income taxes, if any, over an indefinite period

and foreign tax credit carryforwards of $9.5 million with an expiration date of 2014. The Company

also has deferred tax assets related to various state net operating losses of $23.4 million, net of the

valuation allowance, that expire between 2005 and 2025.

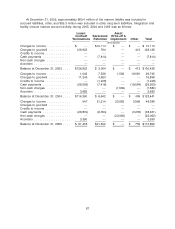

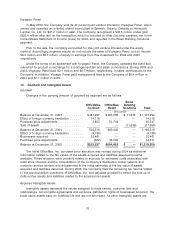

Pretax income (loss) related to continuing operations from domestic and foreign sources is as

follows:

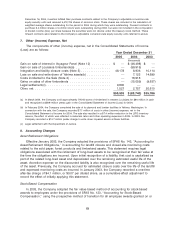

Year Ended December 31

2005 2004 2003

(thousands)

Domestic .......................................... $(65,073) $340,484 $11,580

Foreign ........................................... 27,457 38,958 37,660

Total pretax income .................................. $(37,616) $379,442 $49,240

As of December 31, 2005, the Company had undistributed earnings and profits of foreign

operations of approximately $243 million. The Company has not provided any income tax for

jurisdictions in which it has determined that it has permanently reinvested its earnings. During 2005,

the Company provided for $4.7 million in Federal income taxes related to the anticipated

repatriation of earnings related to its investment in a Mexican joint venture.

The Company has established, and periodically reviews, an estimated contingent tax liability to

provide for the possibility of unfavorable outcomes in tax matters. Contingent tax liabilities totaled

$66.7 million as of December 31, 2005, and are included in other noncurrent liabilities in the

Consolidated Balance Sheet. These liabilities are provided for when considered probable and

estimable, consistent with the requirements of SFAS No. 5, ‘‘Accounting for Contingencies.’’

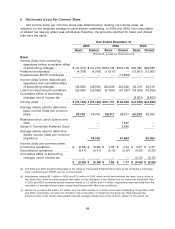

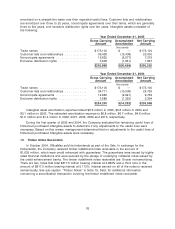

10. Leases

The Company leases its retail stores as well as other property and equipment under operating

leases. These leases are noncancelable and generally contain multiple renewal options for periods

ranging from three to five years, and require the Company to pay all executory costs such as

maintenance and insurance. Rental payments include minimum rentals plus, in some cases,

contingent rentals based on a percentage of sales above specified minimums. Rental expense for

operating leases included the following components:

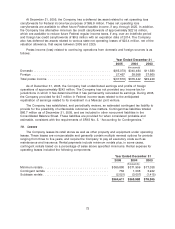

Year Ended December 31

2005 2004 2003

(thousands)

Minimum rentals .................................... $365,880 $371,959 $77,038

Contingent rentals .................................. 752 1,036 3,222

Sublease rentals .................................... (2,021) (3,007) (1,415)

$364,611 $369,988 $78,845

73