OfficeMax 2005 Annual Report Download - page 78

Download and view the complete annual report

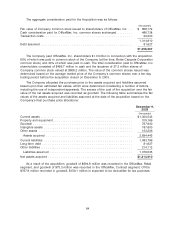

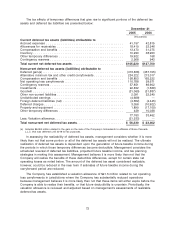

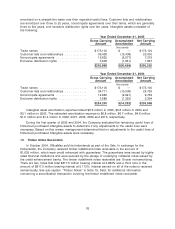

Please find page 78 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For operating leases with remaining terms of more than one year, the minimum lease payment

requirements are: $361.0 million for 2006, $315.1 million for 2007, $284.3 million for 2008,

$255.4 million for 2009, $229.5 million for 2010 and $762.3 million thereafter. These minimum lease

payments do not include contingent rental payments that may be due based on a percentage of

sales in excess of stipulated amounts. These future minimum lease payment requirements also

have not been reduced by $68.4 million of minimum sublease rentals due in the future under

noncancelable subleases.

The Company capitalizes lease obligations for which it assumes substantially all property rights

and risks of ownership. The Company did not have any material capital leases during any of the

periods presented.

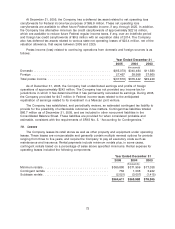

11. Sales of Accounts Receivable

On June 20, 2005, the Company entered into a Third Amended and Restated Receivables Sale

Agreement with a group of lenders. The agreement allows the Company to sell, on a revolving

basis, an undivided interest in a defined pool of receivables while retaining a subordinated interest

in a portion of the receivables. The amount of available proceeds under the program is limited to

$200 million, and is subject to change based on the level of eligible receivables, restrictions on

concentrations of receivables and the historical performance of the receivables. The receivables

sale agreement will expire on June 19, 2006.

The eligible receivables are sold without legal recourse to third party conduits through a wholly

owned bankruptcy-remote special purpose entity that is consolidated for financial reporting

purposes. The Company continues servicing the sold receivables and charges the third party

conduits a monthly servicing fee at market rates. The program qualifies for sale treatment under

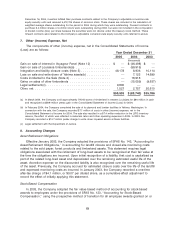

SFAS 140. At December 31, 2005 and 2004, $163.0 million and $120.0 million of sold accounts

receivable were excluded from receivables in the accompanying Consolidated Balance Sheets. The

Company’s subordinated retained interest in the transferred receivables was $73.3 million at

December 31, 2005. Expenses associated with the securitization program totaled $5.5 million,

$4.2 million and $3.3 million, in 2005, 2004 and 2003, respectively. These expenses relate primarily

to the loss on sale of receivables and discount on retained interests, facility fees and professional

fees associated with the program, and are included in the Consolidated Statements of Income

(Loss).

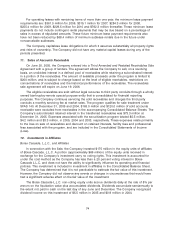

12. Investments in Affiliates

Boise Cascade, L.L.C., and Affiliates

In connection with the Sale, the Company invested $175 million in the equity units of affiliates

of Boise Cascade, L.L.C. A portion (approximately $66 million) of the equity units received in

exchange for the Company’s investment carry no voting rights. This investment is accounted for

under the cost method as the Company has less than a 20 percent voting interest in Boise

Cascade L.L.C. and does not have the ability to significantly influence its operating and financial

policies. This investment is included in investment in affiliates in the Consolidated Balance Sheet.

The Company has determined that it is not practicable to estimate the fair value of this investment.

However, the Company did not observe any events or changes in circumstances that would have

had a significant adverse effect on the fair value of the investment.

The Boise Cascade L.L.C. non-voting equity units accrue dividends daily at the rate of 8% per

annum on the liquidation value plus accumulated dividends. Dividends accumulate semiannually to

the extent not paid in cash on the last day of any June and December. The Company recognized

dividend income on this investment of $5.5 million in 2005 and $0.9 million in 2004.

74