OfficeMax 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion contains statements about our future financial performance. These

statements are only predictions. Our actual results may differ materially from these predictions. In

evaluating these statements, you should review Item 1A, ‘‘Risk Factors’’ of this Form 10-K, including

‘‘Cautionary and Forward-Looking Statements.’’

Executive Summary

During 2005, we continued our transition from a manufacturing company operating in the

paper, forest products and building materials industry to an office products distribution company. In

2005, sales were $9.2 billion, compared to $13.3 billion in 2004, and we reported a net loss of

$73.8 million, or $.99 per diluted share, compared with net income of $173.1 million, or $1.77 per

diluted share, for the same period in 2004. Financial results in 2004 include the results of our paper,

forest products, and timberland assets, which were sold in October 2004.

Results for 2005 and 2004 include various items associated with our transition to an

independent office products distribution company, including a loss from discontinued operations,

which are not expected to be ongoing. Some of these items include:

• In 2005, we recognized $91.6 million of pretax charges primarily relating to the write-down of

impaired assets at certain retail stores, the restructuring of our international operations, the

relocation and consolidation of our corporate headquarters, a legal settlement with the

Department of Justice, and severance payments and professional fees. The legal settlement

involved the payment to the United States of $9.8 million to settle allegations that the

Company submitted false claims when it sold office supply products manufactured in

countries not permitted by the Trade Agreements Act to United States governmental

agencies. We also incurred $14.4 million of costs related to our early retirement of debt, and

recorded a $28.2 million pretax charge for the write-down of impaired assets at our Elma,

Washington manufacturing facility, which is accounted for as a discontinued operation.

• In 2004, we completed the Sale and recorded a $280.6 million pretax gain. We monetized

the timber installment notes we received in exchange for our timberlands for proceeds of

$1.5 billion in December 2004, and recognized $19 million in expenses related to the change

in the fair value of interest rate swaps we entered into in anticipation of the securitization

transaction. We used a portion of the proceeds from the Sale to reduce our debt, and

recorded $137.1 million of costs related to the early retirement of debt. Our results for 2004

also include a pretax gain of $59.9 million on the sale of approximately 79,000 acres of

timberland located in western Louisiana, and a pretax gain of $46.5 million on the sale of our

47% interest in Voyageur Panel, as well as a $67.8 million pretax charge for the write-down of

impaired assets at our Elma, Washington, manufacturing facility.

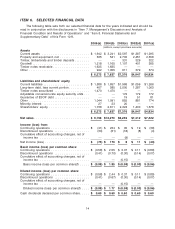

A number of items related to our transition also impacted our financial position as of

December 31, 2005. As of December 31, 2005, we had $72.2 million of cash and cash equivalents

and $494.6 million of short-term and long-term debt, excluding the $1.5 billion of timber

securitization notes. During 2005, we reduced our net debt by $198.7 million, and expensed

$14.4 million of costs related to the early retirement of debt. During 2004, we paid down $1.6 billion

of our debt, primarily with the proceeds of the Sale, and expensed $137.1 million of costs related to

the early retirement of debt. During 2004, we announced plans to return between $800 million and

$1 billion of the Sale proceeds to shareholders via common or preferred stock buybacks, cash

dividends or a combination of these alternatives. As part of this commitment to return cash to

equity holders we redeemed $110 million of our Series D preferred stock on November 1, 2004.

16