OfficeMax 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for three-month LIBOR. The first interest payment on the debentures at the reset rate was made on

December 16, 2004, at a rate of 4.62% per annum. On November 5, 2004, we repurchased

$144.5 million of these debentures pursuant to an offer to purchase these securities. We made an

open market purchase of an additional $15.2 million of the debentures in December 2004. The

remaining $12.8 million of the debentures were repurchased in February 2005.

On December 16, 2004, holders of our adjustable conversion-rate equity security units received

1.5689 of our common shares upon settlement of each purchase contract, resulting in the issuance

of a total of 5,412,705 shares. We received $50 per unit, or $172.5 million, as a result of the

settlement of the purchase contracts.

Other

During 2003, we agreed to enter into a $33.5 million sale-leaseback of equipment at our

integrated wood-polymer building materials facility near Elma, Washington. The sale-leaseback has

a base term of seven years and an interest rate of 4.67%, was accounted for as a financing

arrangement, and is included in ‘‘Long-term debt, less current portion’’ in our Consolidated Balance

Sheet. The outstanding balance at December 31, 2005 of this obligation was $26.6 million. In 2006,

we terminated this sale-leaseback agreement as part of our decision to cease operations at this

facility.

As of December 31, 2005, we had $35.8 million of 9.45% debentures that are due in 2009. The

9.45% debentures contain a provision under which, in the event of the occurrence of both a

designated event, as defined (generally a change of control or a major distribution of assets) and a

subsequent rating decline, as defined, the holders of these securities may require the Company to

redeem the securities.

Previously, OfficeMax guaranteed the debt used to fund our employee stock ownership plan

(‘‘ESOP’’) that was part of the Savings and Supplemental Retirement Plan for our U.S. salaried

employees. The debt was repaid in 2004. We have guaranteed tax indemnities on the ESOP debt.

Although the debt was paid, under these indemnities, we would be required to pay additional

amounts to the debt holders if the interest payments on the debt were determined to be taxable.

Any amounts paid under this tax indemnification would be dependent upon future tax rulings and

assessments by the Internal Revenue Service and are not quantifiable at this time.

Cash Paid for Interest

Cash payments for interest, net of interest capitalized, were $122.6 million in 2005,

$167.7 million in 2004 and $128.3 million in 2003. The decline in payments made in 2005 relative to

2004 was due to the repayment of outstanding debt in the fourth quarter of 2004 using a portion of

the proceeds from the Sale. The level of payments made in 2004 increased over 2003 due to

higher debt levels during most of 2004 related to additional borrowings to provide cash for the

OfficeMax, Inc. acquisition.

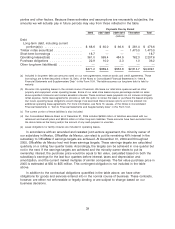

Contractual Obligations

In the table below, we set forth our contractual obligations as of December 31, 2005. Some of

the figures we include in this table are based on management’s estimates and assumptions about

these obligations, including their duration, the possibility of renewal, anticipated actions by third

38