OfficeMax 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

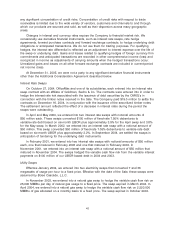

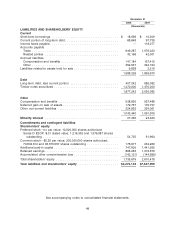

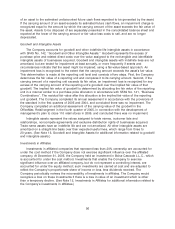

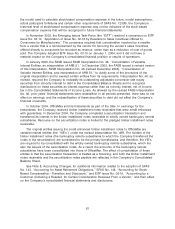

OfficeMax Incorporated and Subsidiaries

Consolidated Statements of Shareholders’ Equity

For the Years Ended December 31, 2003, 2004 and 2005

Total Accumulated

Common Share- Deferred Additional Other

Shares holders’ Preferred ESOP Common Paid-In Retained Comprehensive

Outstanding Equity Stock Benefit Stock Capital Earnings Loss

(thousands, except share amounts)

58,283,719 Balance at December 31, 2002 .................$1,399,531 $ 192,628 $ (51,448) $145,709 $ 474,533 $ 952,215 $ (314,106)

Comprehensive income

Net income .......................... 8,272 — — — — 8,272 —

Other comprehensive income, net of tax

Cumulative foreign currency translation adjustment . . . . 65,472 — — — — — 65,472

Cash flow hedges . . . . .................. 1,887 — — — — — 1,887

Minimum pension liability adjustment ............ 52,929 — — — — — 52,929

Other comprehensive income ................. 120,288 — — — — — 120,288

Comprehensive income . ...................$ 128,560

Cash dividends declared

Common stock . . . . . . . . ................ (39,445) — — — — (39,445) —

Preferred stock . . . . . . . . ................ (13,864) — — — — (13,864) —

27,316,955 Stock issued for acquisition . .................. 808,172 — — 68,292 739,880 — —

1,215,118 Restricted stock . . . ...................... 6,461 — — — 6,461 — —

713 Restricted stock vested ..................... — — — 2 (2) — —

319,139 Stock options exercised ..................... 8,554 — — 798 7,756 — —

(2,006) Treasury stock cancellations . .................. (7,378) (7,326) — (5) (16) (31) —

3,668 Other . . . . . . ......................... 33,043 — 32,361 9 82 591 —

87,137,306 Balance at December 31, 2003 .................$2,323,634 $ 185,302 $ (19,087) $ 214,805 $ 1,228,694 $ 907,738 $ (193,818)

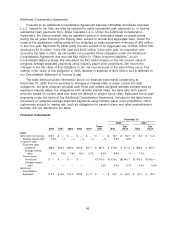

Comprehensive income

Net income .......................... 173,058 — — — — 173,058 —

Other comprehensive income, net of tax

Cumulative foreign currency translation adjustment . . . . 29,933 — — — — — 29,933

Cash flow hedges . . . . .................. 159 — — — — — 159

Minimum pension liability adjustment ............ 19,027 — — — — — 19,027

Other comprehensive income ................. 49,119 — — — — — 49,119

Comprehensive income . ...................$ 222,177

Cash dividends declared

Common stock . . . . . . . . ................ (52,284) — — — — (52,284) —

Preferred stock . . . . . . . . ................ (12,211) — — — — (12,211) —

5,412,705 Conversion of ACES to common stock ............. 172,500 — — 13,532 158,968 — —

(547,275) Restricted stock . . . ...................... 19,579 — — — 19,579 — —

365,787 Restricted stock vested ..................... — — — 915 (915) — —

1,202,308 Stock options exercised ..................... 37,823 — — 3,006 34,817 — —

(3,129) Treasury stock cancellations . .................. (123,437) (123,338) — (8) (91) — —

7,855 Other . . . . . . ......................... 22,697 — 19,087 19 213 3,378 —

93,575,557 Balance at December 31, 2004 .................$2,610,478 $ 61,964 $ — $ 232,269 $ 1,441,265 $ 1,019,679 $ (144,699)

Comprehensive income (loss)

Net loss . . . . . . . . . ................... (73,762) — — — — (73,762) —

Other comprehensive income, net of tax

Cumulative foreign currency translation adjustment . . . . (6,037) — — — — — (6,037)

Minimum pension liability adjustment ............ 8,615 — — — — — 8,615

Other comprehensive income ................. 2,578 — — — — — 2,578

Comprehensive income (loss) .................$ (71,184)

Cash dividends declared

Common stock . . . . . . . . ................ (47,082) — — — — (47,082) —

Preferred stock . . . . . . . . ................ (4,379) — — — — (4,379) —

Restricted stock . . . ...................... 9,184 — — — 9,184 — —

(199,134) Restricted stock vested ..................... — — — 1,134 (1,134) — —

883,817 Stock options exercised ..................... 26,460 — — 2,210 24,250 — —

(23,527,764) Treasury stock cancellations . .................. (781,181) — — (58,819) (722,362) — —

72,136 Other . . . . . . ......................... (6,617) (7,229) — 183 (3,398) 3,827 —

70,804,612 Balance at December 31, 2005 .................$1,735,679 $ 54,735 $ — $176,977 $ 747,805 $ 898,283 $(142,121)

See accompanying notes to consolidated financial statements.

51