OfficeMax 2005 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

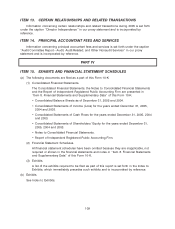

31.2 CFO Certification Pursuant to Section X

302 of the Sarbanes-Oxley Act of

2002

32 Section 906 Certifications of Chief X

Executive Officer and Chief Financial

Officer of OfficeMax Incorporated

† Indicates exhibits that constitute management contracts or compensatory plans or

arrangements.

(a) Certain information in this exhibit has been omitted and filed separately with the Securities and

Exchange Commission pursuant to a confidential treatment request under Rule 24b-2 of the

Securities Exchange Act of 1934, as amended.

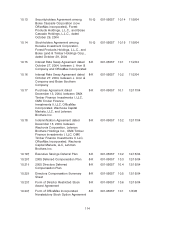

(1) The Trust Indenture between Boise Cascade Corporation (now known as OfficeMax

Incorporated) and Morgan Guaranty Trust Company of New York, Trustee, dated October 1,

1985, as amended, was filed as exhibit 4 in the Registration Statement on Form S-3

No. 33-5673, filed May 13, 1986. The Trust Indenture has been supplemented on seven

occasions as follows: The First Supplemental Indenture, dated December 20, 1989, was filed as

exhibit 4.2 in the Pre-Effective Amendment No. 1 to the Registration Statement on Form S-3

No. 33-32584, filed December 20, 1989. The Second Supplemental Indenture, dated August 1,

1990, was filed as exhibit 4.1 in our Current Report on Form 8-K filed on August 10, 1990. The

Third Supplemental Indenture, dated December 5, 2001, between Boise Cascade Corporation

and BNY Western Trust Company, as trustee, to the Trust Indenture dated as of October 1,

1985, between Boise Cascade Corporation and U.S. Bank Trust National Association (as

successor in interest to Morgan Guaranty Trust Company of New York) was filed as exhibit 99.2

in our Current Report on Form 8-K filed on December 10, 2001. The Fourth Supplemental

Indenture dated October 21, 2003, between Boise Cascade Corporation and U.S. Bank Trust

National Association was filed as exhibit 4.1 in our Current Report on Form 8-K filed on

October 20, 2003. The Fifth Supplemental Indenture dated September 16, 2004, among Boise

Cascade Corporation, U.S. Bank Trust National Association and BNY Western Trust Company

was filed as exhibit 4.1 to our Current Report on Form 8-K filed on September 22, 2004. The

Sixth Supplemental Indenture dated October 29, 2004, between OfficeMax Incorporated and

U.S. Bank Trust National Association was filed as exhibit 4.1 to our Current Report on Form 8-K

filed on November 4, 2004. The Seventh Supplemental Indenture, made as of December 22,

2004, between OfficeMax Incorporated and U.S. Bank Trust National Association was filed as

exhibit 4.1 to our Current Report on Form 8-K filed on December 22, 2004. Each of the

documents referenced in this footnote is incorporated by reference.

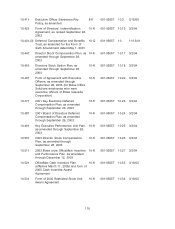

(2) The First Amendment to Employment Agreement with George J. Harad was filed as exhibit 10.1

in our Current Report on Form 8-K filed on December 15, 2004. The document referenced in

this footnote is incorporated by reference.

(3) The Deferred Compensation and Benefits Trust, as amended and restated as of December 13,

1996, was filed as exhibit 10.18 in our Annual Report on Form 10-K for the year ended

December 31, 1996. Amendment No. 4, dated July 29, 1999, to the Deferred Compensation

and Benefits Trust was filed as exhibit 10.18 in our Annual Report on Form 10-K for the year

ended December 31, 1999. Amendment No. 5, dated December 6, 2000, to the Deferred

Compensation and Benefits Trust was filed as exhibit 10.18 in our Annual Report on Form 10-K

for the year ended December 31, 2000. Amendment No. 6, dated May 1, 2001, to the Deferred

Compensation and Benefits Trust was filed as exhibit 10 in our Quarterly Report on Form 10-Q

for the quarter ended September 30, 2001. Each of the documents referenced in this footnote

is incorporated by reference.

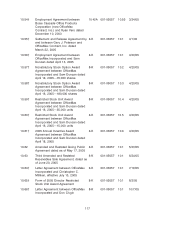

(4) Our Code of Ethics can be found on our website (www.officemax.com) by clicking on ‘‘About

us,’’ ‘‘Investors’’ and then ‘‘Code of Ethics.’’

119