OfficeMax 2005 Annual Report Download - page 11

Download and view the complete annual report

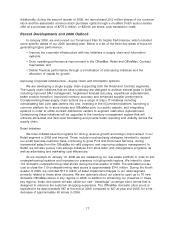

Please find page 11 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sites, develop remodeling plans, hire and train associates and adapt management and systems to

meet the needs of these operations. These tasks are difficult to manage successfully. If we are not

able to open and remodel stores as quickly as we have planned, our future financial performance

could be materially and adversely affected. Further, we cannot ensure that the new or remodeled

stores will achieve the sales or profit levels that we anticipate. This is particularly true as we

introduce different store designs, formats and sizes or enter into new market areas. In particular, the

‘‘Advantage’’ prototype store format we intend to utilize for new and remodeled stores is new and

there can be no assurance as to whether or to what extent that format will be successful.

Economic conditions directly influence our operating results. Economic conditions, both

domestically and abroad, directly influence our operating results. Current economic conditions,

including the level of unemployment and energy costs, may adversely affect our business and the

results of our operations.

Our quarterly operating results are subject to fluctuation. Our quarterly operating results

have fluctuated in the past and are likely to do so in the future. Factors that may contribute to these

quarter-to-quarter fluctuations could include the effects of seasonality, our level of advertising and

marketing, new store openings, changes in product mix and competitors’ pricing. These quarterly

fluctuations could have an adverse effect on both our operating results and the price of our

common stock.

Our operating results may be adversely affected if we are unable to attract and retain key

personnel. In conjunction with our headquarters consolidation, we will need to hire approximately

600 new employees to replace existing associates who are not relocating to the new headquarters.

We may not be successful in attracting and retaining highly qualified associates. Additionally, we

may not be able to continue to attract and retain other key personnel in the future. The inability to

continue to attract and retain other key personnel could adversely affect our operating results.

We cannot ensure the headquarters consolidation will go smoothly. The consolidation of

our headquarters in Naperville, Illinois in 2006 not only requires the hiring of approximately 600 new

associates as discussed above, it also involves the relocation of our data center and other key

corporate functions. Unanticipated complications in the headquarters consolidation could adversely

affect our operating results.

We have more indebtedness than some of our key competitors, which could adversely

affect our cash flows, business and ability to fulfill our debt obligations. Although we have

repaid a significant portion of our debt with the proceeds from the Sale, we will still have more debt

than several of our key competitors. Because we have more debt, we are required to dedicate a

portion of our cash flow from operations to repay debt. This reduces the funds we have available

for working capital, capital expenditures, acquisitions, new stores, store remodels and other

purposes. Similarly, our larger debt levels increase our vulnerability to, and limit our flexibility in

planning for, adverse economic and industry conditions and create other competitive disadvantages

compared with other companies with lower debt levels.

We cannot ensure the completion of our integration efforts will be successful. Our

acquisition of OfficeMax, Inc., in December 2003, required the integration and coordination of our

existing contract stationer operations with the retail operations of the acquired company. We have

not completed the integration of these operations. Integrating and coordinating these operations

has involved complex operational and personnel-related challenges. This process will continue to

be time-consuming and expensive, may disrupt our day-to-day business activities and may not

result in the full benefits that we expect. The difficulties, costs and delays that we could still

encounter include unanticipated issues in integrating information, communications and other

systems; the loss of customers; unanticipated incompatibility of purchasing, logistics, marketing,

7