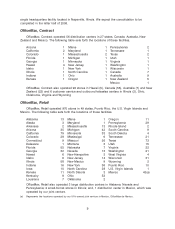

OfficeMax 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.from the Sale, after allowing for the $175 million reinvestment in affiliates of Boise Cascade, L.L.C.

and transaction related expenses.

The consideration for the timberlands portion of the Sale included $1.6 billion of timber

installment notes. We monetized the timber installment notes in December 2004 for proceeds of

$1.5 billion. We realized net cash proceeds from the Sale of $3.3 billion in 2004 after allowing for

the $175 million reinvestment, transaction-related expenses and the monetization of the timber

installment notes. See Note 14, Timber Notes Receivable and Note 15, Debt, of the Notes to

Consolidated Financial Statements in ‘‘Item 8. Financial Statements and Supplementary Data’’ of

this Form 10-K for additional information related to the timber notes.

Through debt repurchases and retirements, we reduced our short-term and long-term debt to

$494.6 million at December 31, 2005, excluding the $1.5 billion of timber notes securitized. During

the fourth quarter of 2004, we reduced our debt by $1.8 billion, expensed $137.1 million of costs

related to the early retirement of debt, and made a $45.8 million contribution to the pension plans

on behalf of active employees who became employees of Boise Cascade, L.L.C. During 2005, we

reduced our long-term debt by $198.7 million and expensed $14.4 million of costs related to early

retirement of debt.

During 2004, we also announced plans to return between $800 million and $1 billion of the

Sale proceeds to shareholders via common or preferred stock buybacks, cash dividends or a

combination of these alternatives. As part of this commitment to return cash to equity holders, we

redeemed $110 million of our Series D preferred stock and paid related accrued dividends of

$3 million in the fourth quarter of 2004. In May 2005, we used substantially all of the remaining

proceeds from the Sale to repurchase 23.5 million shares of our common stock and associated

common stock purchase rights through a modified Dutch auction tender offer at a purchase price

of approximately $775.5 million, or $33.00 per share, plus transaction costs.

Change in Fiscal Year End

Effective March 11, 2005, we amended our bylaws to make the fiscal year-end for OfficeMax

Incorporated the last Saturday in December. Prior to this amendment, all of our segments except

OfficeMax, Retail had a December 31 fiscal year-end. Our U.S. retail operations maintained a fiscal

year that ended on the last Saturday in December, which in 2004 was December 25. Fiscal year

2005 ended on December 31, 2005 for all our reportable segments and businesses. Accordingly,

fiscal year 2005 included 53 weeks for our retail segment. Year-over-year comparisons of

same-location sales are calculated based on an equal number of selling days in each year.

19