OfficeMax 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

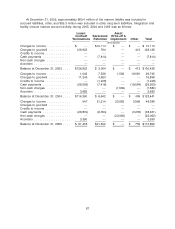

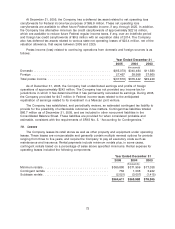

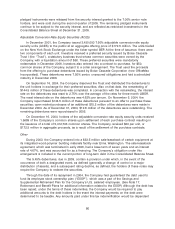

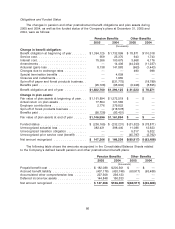

15. Debt

Long-Term Debt

Long-term debt, almost all of which is unsecured, consists of the following:

December 31

2005 2004

(thousands)

7.05% notes, due in 2005 .................................. $ — $ 43,972

7.50% notes, due in 2008 .................................. 29,601 29,656

9.45% debentures, due in 2009 .............................. 35,764 35,707

6.50% notes, due in 2010 .................................. 13,680 13,680

7.00% notes, due in 2013 .................................. 19,100 106,393

7.35% debentures, due in 2016 .............................. 17,966 17,967

Medium-term notes, Series A, with interest rates averaging 7.8% and

7.7%, due in varying amounts annually through 2013 ............. 121,000 172,145

Revenue bonds, with interest rates averaging 6.4% and 6.4%, due in

varying amounts annually through 2029 ...................... 189,930 200,815

American & Foreign Power Company Inc. 5% debentures, due in 2030 . 18,469 18,526

Other indebtedness, with interest rates averaging 7.1% and 5.5%, due in

varying amounts annually through 2017 ...................... 31,044 44,738

476,554 683,599

Less unamortized discount ................................. 664 779

Less current portion ...................................... 68,648 97,738

407,242 585,082

5.42% timber notes, due in 2019 ............................. 735,000 735,000

5.54% timber notes, due in 2019 ............................. 735,000 735,000

$1,877,242 $2,055,082

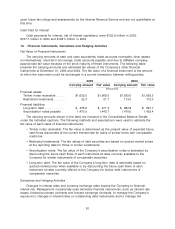

In 2004, the Company repaid approximately $1.6 billion of outstanding debt, primarily with the

proceeds from the Sale, and expensed $137.1 million of costs related to the early retirement of

debt. In 2005, the Company expensed an additional $14.4 million of costs related to the early

retirement of debt and repaid an additional $198.7 million of outstanding debt.

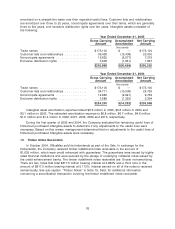

Scheduled Debt Maturities

The scheduled payments of long-term debt are $68.6 million in 2006, $25.4 million in 2007,

$34.6 million in 2008, $50.9 million in 2009 and $15.7 million in 2010 and $281.4 million thereafter.

Credit Agreements

On June 24, 2005, the Company entered into a loan and security agreement for a new

revolving credit facility. The new revolver replaces the Company’s previous revolving credit facility,

which was scheduled to expire on June 30, 2005. The revolving credit facility permits the Company

to borrow up to the maximum aggregate borrowing amount, which is equal to the lesser of (i) a

percentage of the value of certain eligible inventory less certain reserves or (ii) $500 million. Letters

of credit, which may be issued under the revolver up to a maximum of $100 million, reduce

available borrowing capacity under the revolving credit facility. There were $18.7 million in

borrowings outstanding under the new revolver as of December 31, 2005. Borrowings under the

revolver are classified as current liabilities as the Company plans to repay them on a short-term

basis. The minimum and maximum amounts outstanding under the revolving credit facility were

77