OfficeMax 2005 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

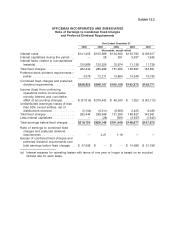

Exhibit 11

OFFICEMAX INCORPORATED AND SUBSIDIARIES

Computation of Per Share Earnings

Year Ended December 31

2005 2004 2003

(thousands, except per-share amounts)

Basic

Income (loss) from continuing operations ................ $(41,212) $ 234,125 $ 35,380

Preferred dividends(a) .............................. (4,378) (11,917) (13,061)

Basic income (loss) before discontinued operations and

cumulative effect of accounting changes ............... (45,590) 222,208 22,319

Loss from discontinued operations ..................... (32,550) (61,067) (18,305)

Cumulative effect of accounting changes, net of income tax . . . — — (8,803)

Basic income (loss) ................................ $ (78,140) $161,141 $ (4,789)

Average shares used to determine basic income (loss) per

common share .................................. 78,745 86,917 60,093

Basic income (loss) per common share:

Continuing operations ............................. $ (0.58) $ 2.55 $ 0.37

Discontinued operations ........................... (0.41) (0.70) (0.30)

Cumulative effect of accounting changes, net of income tax . . — — (0.15)

Basic income (loss) per common share .................. $ (0.99) $ 1.85 $ (0.08)

Diluted

Basic income (loss) before discontinued operations and

cumulative effect of accounting changes ............... $(45,590) $ 222,208 $ 22,319

Preferred dividends eliminated ........................ — 11,917 13,061

Supplemental ESOP contribution ....................... — (10,833) (11,829)

Diluted income (loss) before discontinued operations and

cumulative effect of accounting changes ............... (45,590) 223,292 23,551

Loss from discontinued operations ..................... (32,550) (61,067) (18,305)

Cumulative effect of accounting changes, net of income tax . . . — — (8,803)

Diluted income (loss) ............................... $ (78,140) $162,225 $ (3,557)

Average shares used to determine basic income (loss) per

common share .................................. 78,745 86,917 60,093

Restricted stock, stock options and other ................. — 1,857 734

Series D Convertible Preferred Stock .................... — 2,880 3,353

Average shares used to determine diluted income (loss) per

common share .................................. 78,745 91,654 64,180

Diluted income (loss) per common share:

Continuing operations ............................. $ (0.58) $ 2.44 $ 0.37

Discontinued operations ........................... (0.41) (0.67) (0.29)

Cumulative effect of accounting changes, net of income tax . . — — (0.14)

Diluted income (loss) per common share(b) ............... $ (0.99) $ 1.77 $ (0.06)

(a) The dividend attributable to the company’s Series D Convertible Preferred Stock held by the

company’s ESOP (employee stock ownership plan) is net of a tax benefit.

(b) For the years ended December 31, 2005 and 2003, the computation of diluted loss per

common share was antidilutive; therefore, amounts reported for basic and diluted loss were the

same.