OfficeMax 2005 Annual Report Download - page 70

Download and view the complete annual report

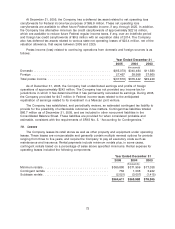

Please find page 70 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.primarily to future lease termination costs, net of estimated sublease income. Most of the

expenditures for these facilities will be made over the remaining lives of the operating leases.

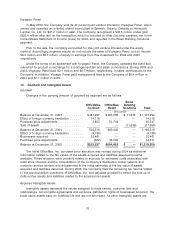

In addition to these store closures, at December 31, 2003, the Company identified and closed

45 OfficeMax, Retail facilities that were no longer strategically and economically viable. As a result,

the Company recorded a $69.4 million liability in the Consolidated Balance Sheet. During 2004, we

identified and closed an additional 11 stores that were no longer strategically or economically

viable. All of the above charges were accounted for as exit activities in connection with the

acquisition and were not recorded as a charge to income.

Since the Acquisition, the Company closed 18 U.S. distribution centers and 2 customer service

centers. In connection with these closures the Company recorded a charge to income in our

Consolidated Statement of Income (Loss) of $29.7 million during 2004.

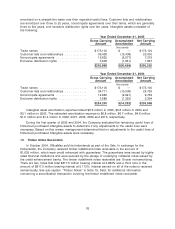

In September 2005, the board of directors approved a plan to relocate and consolidate the

Company’s retail headquarters in Shaker Heights, Ohio and its existing corporate headquarters in

Itasca, Illinois into a new facility in Naperville, Illinois. The relocation and consolidation process is

expected to be completed during the second half of 2006.

Management expects the total cost of the relocation and consolidation will be approximately

$40 to $50 million on a pre-tax basis, and will be recognized in operations during 2005 and 2006.

Such charges are expected to require cash outlays of $15 to $20 million for severance, retention

and other employee costs, and approximately $10 to $15 million for contract termination and other

closure costs. Non-cash charges for accelerated depreciation of facilities and leasehold

improvements are expected to total $10 to $15 million during 2005 and 2006. These estimated

costs do not include expected future expenses for personnel training, recruiting and relocation or

the potential savings from these actions due to expected efficiencies and tax incentives.

The Company recorded charges totaling $25.0 million during the third and fourth quarters of

2005 related to the headquarters relocation and consolidation in the Corporate and Other segment.

Also in 2005, the Company recorded charges to income of $23.2 million for the write-down of

impaired assets related to underperforming retail stores and the restructuring of its Canadian

operations.

66