OfficeMax 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

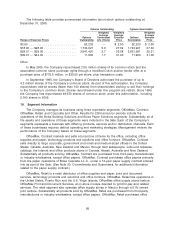

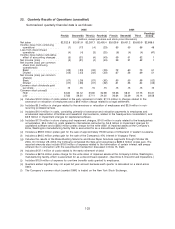

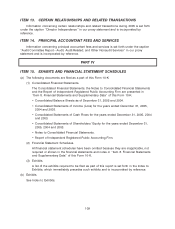

22. Quarterly Results of Operations (unaudited)

Summarized quarterly financial data is as follows:

2005 2004

Fourth(g)

First(a) Second(b) Third(c) Fourth(d) First(e) Second(f) Third (h)(i)(j)

(millions, except per-share and stock price information)

Net sales ................ $2,322.8 $2,091.8 $2,287.7 $2,455.4 $3,529.6 $3,401.2 $3,650.9 $2,688.5

Income (loss) from continuing

operations .............. (1) (17) (.4) (23) 65 55 66 48

Loss from discontinued

operations .............. (4) (4) (3) (20) (6) (4) (4) (47)

Income (loss) before cumulative

effect of accounting changes . . (5) (21) (4) (43) 59 51 62 1

Net income (loss) ........... (5) (21) (4) (43) 59 51 62 1

Net income (loss) per common

share from continuing

operations(k)

Basic ................. (.03) (.23) (.02) (.33) .72 .60 .73 .51

Diluted ................ (.03) (.23) (.02) (.33) .67 .58 .69 .51

Net income (loss) per common

share(k)

Basic ................. (.07) (.28) (.07) (.62) .65 .55 .68 (.02)

Diluted ................ (.07) (.28) (.07) (.62) .61 .53 .64 (.02)

Common stock dividends paid

per share ............... .15 .15 .15 .15 .15 .15 .15 .15

Common stock prices(l)

High.................. 34.84 34.12 33.60 32.99 35.26 38.01 37.75 35.21

Low .................. 27.82 29.50 27.11 24.20 30.64 32.29 30.14 28.58

(a) Includes $12.2 million of costs related to the early retirement of debt, $11.3 million in charges related to the

severance or relocation of employees and a $9.8 million charge related to a legal settlement.

(b) Includes $5.5 million in charges related to the severance or relocation of employees and $3.9 million in non-

recurring professional fees.

(c) Includes $10.4 million in costs, consisting primarily of severance and relocation payments to employees and

accelerated depreciation of facilities and leasehold improvements, related to the headquarters consolidation; and

$2.9 million in impairment charges for capitalized software.

(d) Includes $17.9 million in store closing and impairment charges, $14.5 million in costs related to the headquarters

consolidation, $5.4 million in costs related to international restructuring, $4.8 million in impairment charges for

capitalized software and a $28.2 million pretax charge for the write-down of impaired assets at the Company’s

Elma, Washington manufacturing facility that is accounted for as a discontinued operation.

(e) Includes a $59.9 million pretax gain for the sale of approximately 79,000 acres of timberland in western Louisiana.

(f) Includes a $46.5 million pretax gain for the sale of the Company’s 47% interest in Voyageur Panel.

(g) Includes the results of the Boise Building Solutions and Boise Paper Solutions segments through October 28,

2004. On October 29, 2004, the Company completed the Sale and recognized a $280.6 million pretax gain. The

reported amounts also include $19.0 million of expense related to the termination of certain interest rate swaps

entered into in connection with the securitization transaction discussed in Note 15, Debt.

(h) Includes $137.1 million of costs related to the early retirement of debt.

(i) Includes a $67.8 million pretax charge for the write-down of impaired assets at the Company’s Elma, Washington,

manufacturing facility, which is accounted for as a discontinued operation. (See Note 3, Discontinued Operations.)

(j) Includes $15.9 million of expense for one-time benefits costs granted to employees.

(k) Quarters added together may not equal full year amount because each quarter is calculated on a stand-alone

basis.

(l) The Company’s common stock (symbol OMX) is traded on the New York Stock Exchange.

103