OfficeMax 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Off-Balance-Sheet Activities and Guarantees

On June 20, 2005, we entered into a Third Amended and Restated Receivables Sale

Agreement with a group of lenders. Under this program, we sell fractional ownership interests in a

defined pool of accounts receivable. We account for this sales program under FASB Statement 140,

‘‘Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities’’. We

entered into this program to provide us funding at rates favorable to our other borrowing

arrangements. A portion of our retained interest is subordinate to the interests of the bank affiliates,

providing them credit support if the receivables become uncollectible. The anticipated impact of the

credit support is reflected in our allowance for uncollectible receivables. The amount of available

proceeds under this program is subject to change based on the level of eligible receivables,

restrictions on concentrations of receivables and the historical performance of the receivables. The

proceeds available to us may not exceed $200 million under our current agreements.

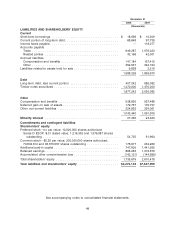

Sold accounts receivable are excluded from ‘‘Receivables’’ in our Consolidated Balance Sheet.

At December 31, 2005, $163.0 million of sold accounts receivable were excluded from

‘‘Receivables’’ in our Consolidated Balance Sheet compared with $120.0 million excluded at

December 31, 2004. The portion of fractional ownership that we retain is included in ‘‘Receivables’’

in our Consolidated Balance Sheet.

The receivables sale agreement will expire June 19, 2006. When the current program expires,

none of the parties are obligated to renew the arrangement. Our experience over the last five years,

however, has been that the parties do renew the arrangement with minimal alterations. If the

program were not renewed, we would seek replacement funding from alternative funding sources.

Use of those sources, however, might result in an increase in our interest expense and an increase

in both liabilities and assets on our Consolidated Balance Sheet.

Guarantees

Note 20, Commitments and Guarantees, of the Notes to Consolidated Financial Statements in

‘‘Item 8. Financial Statements and Supplementary Data’’ in this Form 10-K describes the nature of

our guarantees, including the approximate terms of the guarantees, how the guarantees arose, the

events or circumstances that would require us to perform under the guarantees and the maximum

potential undiscounted amounts of future payments we could be required to make.

Inflationary and Seasonal Influences

Except for the impact of recent increases in energy costs, we believe that neither inflation nor

deflation has had a material effect on our financial condition or results of operations; however, there

can be no assurance that we will not be affected by inflation or deflation in the future. The

company’s business is seasonal, with OfficeMax, Retail showing a more pronounced seasonal trend

than OfficeMax, Contract. Sales in the second quarter and summer months are historically the

slowest of the year. Sales are stronger during the first, third and fourth quarters that include the

important new-year office supply restocking month of January, the back-to-school period and the

holiday selling season, respectively.

Disclosures of Financial Market Risks

Our debt is predominantly fixed-rate. At December 31, 2005, the estimated current market value

of our debt, based on quoted market prices when available or then-current interest rates for similar

obligations with like maturities, including the timber notes, was approximately $35 million less than

the amount of debt reported in the Consolidated Balance Sheet. The estimated fair values of our

other financial instruments, including cash and cash equivalents, receivables and short-term

borrowings are the same as their carrying values. In the opinion of management, we do not have

40