OfficeMax 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

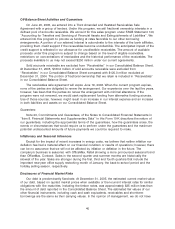

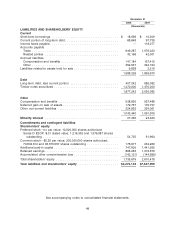

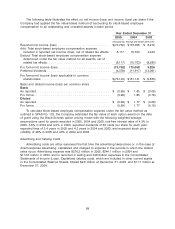

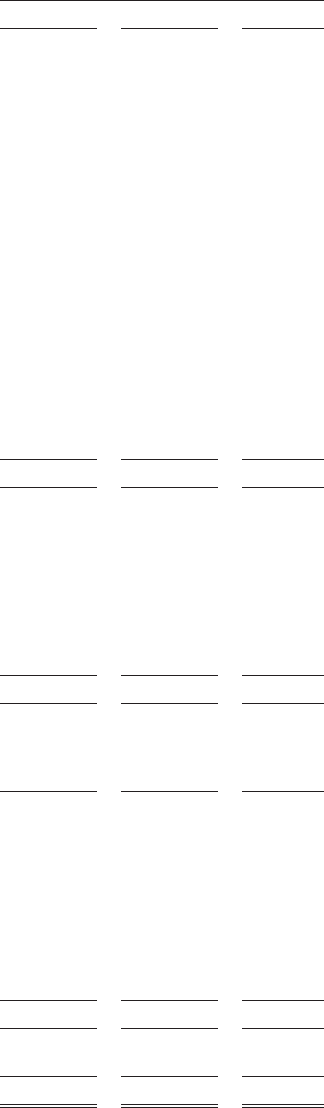

OfficeMax Incorporated and Subsidiaries

Consolidated Statements of Cash Flows

Year Ended December 31

2005 2004 2003

(thousands)

Cash provided by (used for) operations

Net income (loss) .................................. $ (73,762) $ 173,058 $ 8,272

Items in net income (loss) not using (providing) cash

Equity in net income of affiliates ....................... (5,460) (6,311) (8,822)

Depreciation, amortization and cost of company timber

harvested ..................................... 151,145 354,982 307,849

Deferred income tax benefit .......................... (5,007) (15,192) (5,809)

Minority interest, net of income tax ..................... 2,370 3,026 —

Pension and other postretirement benefits expense .......... 25,877 83,261 84,760

Discontinued operations ............................ 8,862 36,457 (11,154)

Gain on sales of assets ............................. (410) (387,218) —

Non-cash asset write-downs .......................... 23,062 1,582 —

Cumulative effect of accounting changes, net of income tax .... — — 8,803

Other ......................................... 38,384 22,027 23,984

Receivables ...................................... 47,517 (490,168) (22,396)

Inventories ....................................... 32,809 (39,630) 73,299

Accounts payable and accrued liabilities ................... (142,582) (15,867) (58,906)

Current and deferred income taxes ...................... (131,622) 84,623 (38,261)

Pension and other postretirement benefits payments .......... — (288,772) (94,811)

Other assets and liabilities ............................ (28,881) 32,993 57,891

Cash provided by (used for) operations .................. (57,698) (451,149) 324,699

Cash provided by (used for) investment

Expenditures for property and equipment .................. (152,450) (290,600) (212,833)

Expenditures for timber and timberlands ................... — (7,642) (10,256)

Investments in affiliates ............................... — (174,901) 127

Acquisition of businesses and facilities, net of cash acquired ..... (34,803) — (432,571)

Restricted investment ................................ 93,259 (113,000) —

Proceeds from sale of assets .......................... — 2,225,561 —

Discontinued operations .............................. — (9,388) 6,404

Other ........................................... (3,343) 15,078 (24,489)

Cash provided by (used for) investment .................. (97,337) 1,645,108 (673,618)

Cash provided by (used for) financing

Cash dividends paid

Common stock ................................... (49,817) (51,874) (35,001)

Preferred stock ................................... (4,379) (12,211) (13,864)

(54,196) (64,085) (48,865)

Short-term borrowings (repayments) ...................... 8,266 5,121 (22,812)

Timber notes securitized .............................. — 1,470,000 —

Additions to long-term debt ............................ — 246 735,712

Payments of long-term debt ........................... (206,933) (1,570,504) (246,589)

Purchase of Series D preferred ......................... (7,229) (123,233) —

Purchase of common shares ........................... (780,417) —

Proceeds from exercise of stock options ................... 24,747 37,823 8,554

Stock issued for adjustable conversion-rate equity security units . . — 172,500 —

Other ........................................... 453 (4,164) (17,354)

Cash provided by (used for) financing ................... (1,015,309) (76,296) 408,646

Increase (decrease) in cash and cash equivalents .......... (1,170,344) 1,117,663 59,727

Balance at beginning of the year ....................... 1,242,542 124,879 65,152

Balance at end of the year ........................... $ 72,198 $ 1,242,542 $ 124,879

See accompanying notes to consolidated financial statements.

50