Kroger 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-23

In April 2015, the FASB issued ASU 2015-04, “Retirement Benefits (Topic 715): Practical Expedient

for the Measurement Date of an Employer’s Defined Benefit Obligation and Plan Assets.” This

amendment permits an entity to measure defined benefit plan assets and obligations using the month

end that is closest to the entity’s fiscal year end for all plans. This guidance will be effective for us in the

fiscal year ending January 28, 2017. The implementation of this amendment will not have an effect on

our Consolidated Statements of Operations, and will not have a significant effect on our Consolidated

Balance Sheets.

In April 2015, the FASB issued ASU 2015-07, “Fair Value Measurement (Topic 820): Disclosures

for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent).” This

amendment removes the requirement to categorize within the fair value hierarchy all investments for

which fair value is measured using the net asset value per share. This guidance will be effective for us

in the fiscal year ending January 28, 2017. The implementation of this amendment will have an effect

on our Notes to the Consolidated Financial Statements and will not have an effect on our Consolidated

Statements of Operations or Consolidated Balance Sheets.

In September 2015, the FASB issued ASU 2015-16, “Business Combinations (Topic 805):

Simplifying the Accounting for Measurement-Period Adjustments.” This amendment eliminates the

requirement to retrospectively account for adjustments made to provisional amounts recognized in a

business combination. This guidance will be effective for us in the fiscal year ending January 28, 2017.

The implementation of this amendment is not expected to have a significant effect on our Consolidated

Financial Statements.

In November 2015, the FASB issued ASU 2015-17, “Income Taxes (Topic 740): Balance Sheet

Classification of Deferred Taxes.” This amendment requires deferred tax liabilities and assets be

classified as noncurrent in a classified statement of financial position. This guidance will be effective

for our fiscal year ending January 28, 2017. Early adoption is permitted. The implementation of this

amendment will not have an effect on our Consolidated Statements of Operations and will not have a

significant effect on our Consolidated Balance Sheets.

In February 2016, the FASB issued ASU 2016-02, “Leases”, which provides guidance for the

recognition of lease agreements. The standard’s core principle is that a company will now recognize most

leases on its balance sheet as lease liabilities with corresponding right-of-use assets. This guidance will

be effective for us in the first quarter of fiscal year ending February 1, 2020. Early adoption is permitted.

The adoption of this ASU will result in a significant increase to our Consolidated Balance Sheets for

lease liabilities and right-of-use assets, and we are currently evaluating the other effects of adoption of

this ASU on our Consolidated Financial Statements. We believe our current off-balance sheet leasing

commitments are reflected in our investment grade debt rating.

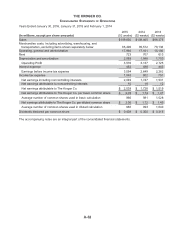

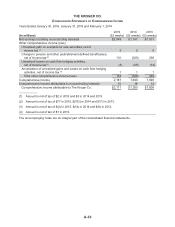

LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Information

Net cash provided by operating activities

We generated $4.8 billion of cash from operations in 2015, compared to $4.2 billion in 2014

and $3.6 billion in 2013. The cash provided by operating activities came from net earnings including

non-controlling interests adjusted primarily for non-cash expenses of depreciation and amortization,

stock compensation, expense for Company-sponsored pension plans, the LIFO charge and changes in

working capital.

The increase in net cash provided by operating activities in 2015, compared to 2014, resulted

primarily due to an increase in net earnings including non-controlling interests, an increase in non-cash

items and changes in working capital. The increase in non-cash items in 2015, as compared to 2014,

was primarily due to increases in depreciation and amortization expense and expense for Company-

sponsored pension plans, partially offset by a lower LIFO charge.