Kroger 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-29

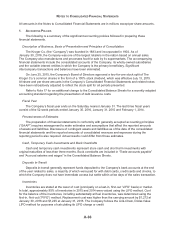

• During the first three quarters of each fiscal year, our LIFO charge and the recognition of LIFO

expense is affected primarily by estimated year-end changes in product costs. Our fiscal year LIFO

charge is affected primarily by changes in product costs at year-end.

• If actual results differ significantly from anticipated future results for certain reporting units including

variable interest entities, an impairment loss for any excess of the carrying value of the reporting

units’ goodwill over the implied fair value would have to be recognized.

• Our effective tax rate may differ from the expected rate due to changes in laws, the status of

pending items with various taxing authorities, and the deductibility of certain expenses.

• Changes in our product mix may negatively affect certain financial indicators. For example, we

continue to add supermarket fuel centers to our store base. Since fuel generates lower profit

margins than our supermarket sales, we expect to see our FIFO gross margins decline as fuel sales

increase.

We cannot fully foresee the effects of changes in economic conditions on Kroger’s business. We

have assumed economic and competitive situations will not change significantly in 2016.

Other factors and assumptions not identified above could also cause actual results to differ

materially from those set forth in the forward-looking information. Accordingly, actual events and results

may vary significantly from those included in, contemplated or implied by forward-looking statements

made by us or our representatives. We undertake no obligation to update the forward-looking information

contained in this filing.