Kroger 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

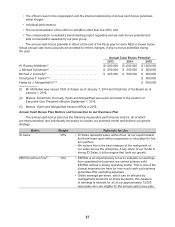

(2) Return on invested capital is calculated by dividing adjusted operating profit for the prior four

quarters by the average invested capital. Adjusted operating profit is calculated by excluding certain

items included in operating profit, and adding our LIFO charge, depreciation and amortization, and

rent. Average invested capital will be calculated as the sum of (i) the average of our total assets,

(ii) the average LIFO reserve, (iii) the average accumulated depreciation and amortization, and

(iv) a rent factor equal to total rent for the last four quarters multiplied by a factor of eight; minus

(i) the average taxes receivable, (ii) the average trade accounts payable, (iii) the average accrued

salaries and wages, and (iv) the average other current liabilities, excluding accrued income taxes.

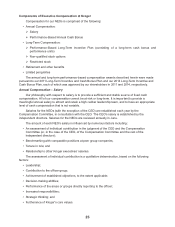

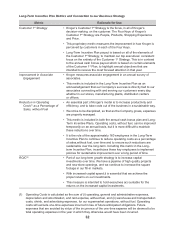

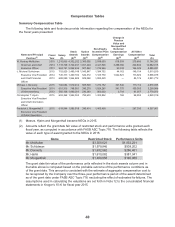

The following table summarizes the Long-Term Incentive Plans adopted for the years shown:

2013 Plan 2014 Plan 2015 Plan

Performance Period 2013 to 2015 2014 to 2016 2015 to 2017

Payout Date March 2016 March 2017 March 2018

Long-term Cash

Bonus Potential

Salary at end of

fiscal year 2012*

Salary at end of

fiscal year 2013*

Salary at end of

fiscal year 2014*

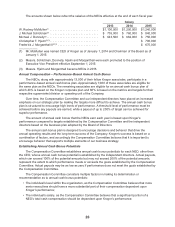

Performance Metrics

Customer 1st Strategy 2% payout per unit

improvement

2% payout per unit

improvement

4% payout per unit

improvement

Improvement in Associate

Engagement

4% payout per unit

improvement

4% payout per unit

improvement

4% payout per unit

improvement

Reduction in Operating Cost as a

Percentage of Sales,

without Fuel

0.50% payout per

0.01% reduction

in operating costs

Baseline: 26.69%

0.50% payout per

0.01% reduction

in operating costs

Baseline: 26.68%

0.50% payout per

0.01% reduction

in operating costs

Baseline: 26.41%

ROIC 1% payout per

0.01% improvement

in ROIC

Baseline: 13.27%

1% payout per

0.01% improvement

in ROIC

Baseline: 13.29%

1% payout per

0.01% improvement

in ROIC

Baseline: 13.76%

* Or date of plan entry, if later.

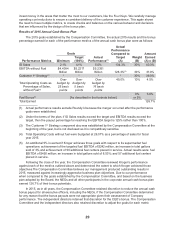

The Compensation Committee has made adjustments to the percentage payouts for the

components of the Long-Term Incentive Plans over time to account for the increasing difficulty of

achieving compounded improvement.

During 2015, Kroger awarded 503,276 performance units to approximately 160 employees,

including the NEOs.