Kroger 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-56

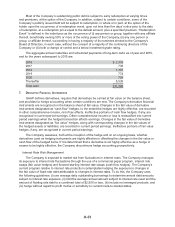

Mergers are accounted for using the acquisition method of accounting, which requires that the

purchase price paid for an acquisition be allocated to the assets and liabilities acquired based on their

estimated fair values as of the effective date of the acquisition, with the excess of the purchase price over

the net assets being recorded as goodwill. See Note 2 for further discussion related to accounting for

mergers.

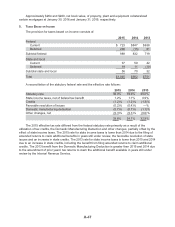

FAIR VALUE OF OTHER FINANCIAL INSTRUMENTS

Current and Long-term Debt

The fair value of the Company’s long-term debt, including current maturities, was estimated based on

the quoted market prices for the same or similar issues adjusted for illiquidity based on available market

evidence. If quoted market prices were not available, the fair value was based upon the net present value

of the future cash flow using the forward interest rate yield curve in effect at respective year-ends. At

January 30, 2016, the fair value of total debt was $12,344 compared to a carrying value of $11,396. At

January 31, 2015, the fair value of total debt was $12,378 compared to a carrying value of $11,026.

Cash and Temporary Cash Investments, Store Deposits In-Transit, Receivables, Prepaid and Other

Current Assets, Trade Accounts Payable, Accrued Salaries and Wages and Other Current Liabilities

The carrying amounts of these items approximated fair value.

Other Assets

The fair values of these investments were estimated based on quoted market prices for those or

similar investments, or estimated cash flows, if appropriate. At January 30, 2016 and January 31, 2015,

the carrying and fair value of long-term investments for which fair value is determinable was $128 and

$133, respectively. At January 30, 2016 and January 31, 2015, the carrying value of notes receivable for

which fair value is determinable was $145 and $98, respectively.

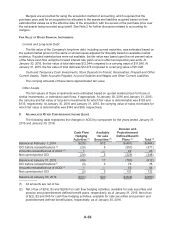

9. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

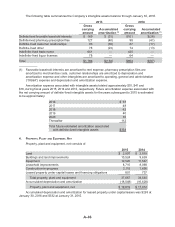

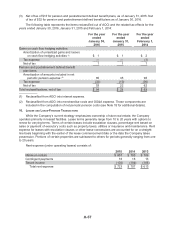

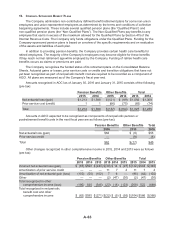

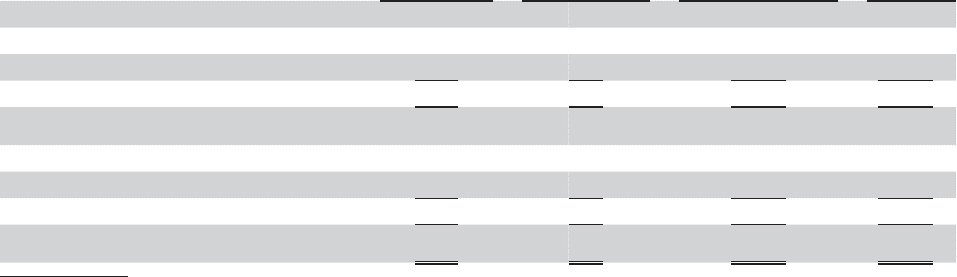

The following table represents the changes in AOCI by component for the years ended January 31,

2015 and January 30, 2016:

Cash Flow

Hedging

Activities (1)

Available

for sale

Securities (1)

Pension and

Postretirement

Defined Benefit

Plans (1) Total (1)

Balance at February 1, 2014 $(25) $12 $(451) $(464)

OCI before reclassifications (2) (25) 5 (351) (371)

Amounts reclassified out of AOCI (3) 1 — 22 23

Net current-period OCI (24) 5 (329) (348)

Balance at January 31, 2015 (49) 17 (780) (812)

OCI before reclassifications (2) (3) 3 78 78

Amounts reclassified out of AOCI (3) 1 — 53 54

Net current-period OCI (2) 3 131 132

Balance at January 30, 2016 $(51) $20 $(649) $(680)

(1) All amounts are net of tax.

(2) Net of tax of $(14), $3 and $(206) for cash flow hedging activities, available for sale securities and

pension and postretirement defined benefit plans, respectively, as of January 31, 2015. Net of tax

of $(2), $2 and $45 for cash flow hedging activities, available for sale securities and pension and

postretirement defined benefit plans, respectively, as of January 30, 2016.