Kroger 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-76

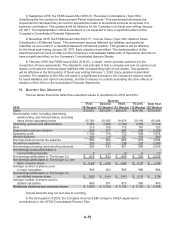

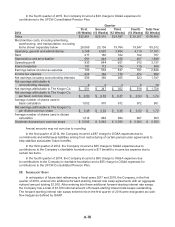

In the fourth quarter of 2015, the Company incurred a $30 charge to OG&A expenses for

contributions to the UFCW Consolidated Pension Plan.

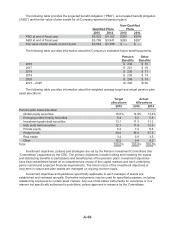

Quarter

2014

First

(16 Weeks)

Second

(12 Weeks)

Third

(12 Weeks)

Fourth

(12 Weeks)

Total Year

(52 Weeks)

Sales $32,961 $25,310 $24,987 $ 25,207 $108,465

Merchandise costs, including advertising,

warehousing, and transportation, excluding

items shown separately below 26,065 20,136 19,764 19,547 85,512

Operating, general and administrative 5,168 3,920 3,954 4,119 17,161

Rent 217 166 162 162 707

Depreciation and amortization 581 444 456 467 1,948

Operating profit 930 644 651 912 3,137

Interest expense 147 112 114 115 488

Earnings before income tax expense 783 532 537 797 2,649

Income tax expense 274 182 172 274 902

Net earnings including noncontrolling interests 509 350 365 523 1,747

Net earnings attributable to

noncontrolling interests 8 3 3 5 19

Net earnings attributable to The Kroger Co. $ 501 $ 347 $ 362 $ 518 $ 1,728

Net earnings attributable to The Kroger Co.

per basic common share $ 0.50 $ 0.35 $ 0.37 $ 0.53 $ 1.74

Average number of shares used in

basic calculation 1,002 970 972 972 981

Net earnings attributable to The Kroger Co.

per diluted common share $ 0.49 $ 0.35 $ 0.36 $ 0.52 $ 1.72

Average number of shares used in diluted

calculation 1,014 982 984 987 993

Dividends declared per common share $ 0.083 $ 0.083 $ 0.093 $ 0.093 $ 0.350

Annual amounts may not sum due to rounding.

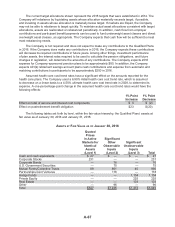

In the first quarter of 2014, the Company incurred a $87 charge to OG&A expenses due to

commitments and withdrawal liabilities arising from restructuring of certain pension plan agreements to

help stabilize associates’ future benefits.

In the third quarter of 2014, the Company incurred a $25 charge to OG&A expenses due to

contributions to the Company’s charitable foundation and a $17 benefit to income tax expense due to

certain tax items.

In the fourth quarter of 2014, the Company incurred a $60 charge to OG&A expenses due

to contributions to the Company’s charitable foundation and a $55 charge to OG&A expenses for

contributions to the UFCW Consolidated Pension Plan.

20. SUBSEQUENT EVENT

In anticipation of future debt refinancing in fiscal years 2017 and 2018, the Company, in the first

quarter of 2016, entered into additional forward-starting interest rate swap agreements with an aggregate

notional amount totaling $1,300. After entering into these additional forward-starting interest rate swaps,

the Company has a total of $1,700 notional amount of forward-starting interest rate swaps outstanding.

The forward-starting interest rate swaps entered into in the first quarter of 2016 were designated as cash-

flow hedges as defined by GAAP.