Kroger 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

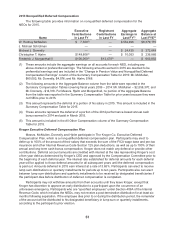

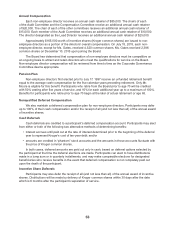

Harris Teeter Flexible Deferral Plan

Mr. Morganthall participates in the HT Flexible Deferral Plan, which is a nonqualified deferred

compensation plan that provides certain highly compensated employees of Harris Teeter, the opportunity

to defer the receipt and taxation on a portion of their annual compensation and supplements the benefits

under tax qualified retirement plans to the extent that such benefits are subject to limitation under the

Internal Revenue Code. Participants may elect to defer up to 50% of their base salary and up to 90% of

their non-equity incentive bonus compensation. Harris Teeter provides matching contributions of 50%

of the participant’s contribution, up to a maximum of 4% of the participant’s pay, less assumed matching

contributions under the HT Savings Plan. These deferred amounts and Company match are credited

to the participant’s account. Plan participants may choose deemed investments in the HT Flexible

Deferral Plan that represent choices that span a variety of diversified asset classes. Participants may

elect to receive a lump sum distribution, annual installment payments for 2-15 years, or a partial lump

sum and installment payments. Upon retirement, death, disability, or other separation of service, the

participant will receive distributions in accordance with his election, subject to limitations under Section

409A. Mr. Morganthall has reached the retirement age and is eligible for the full benefit. The HT Flexible

Deferral Plan also allows for an in-service withdrawal for an unforeseeable emergency based on facts

and circumstances that meet Internal Revenue Service and plan guidelines. Harris Teeter uses a non-

qualified trust to purchase and hold the assets to satisfy Harris Teeter’s obligation under the HT Flexible

Deferral Plan, and participants in the HT Flexible Deferral Plan are general creditors of Harris Teeter in

the event Harris Teeter becomes insolvent.

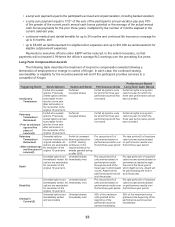

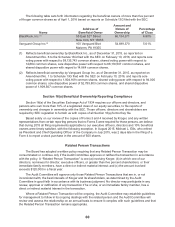

Potential Payments upon Termination or Change in Control

Kroger does not have employment agreements or other contracts, agreements, plans or

arrangements that provide for payments to the NEOs in connection with a termination of employment or

a change in control of Kroger. However, KEPP, our award agreements for stock options, restricted stock

and performance units and our long-term cash bonus plans provide for certain payments and benefits

to participants, including the NEOs, in the event of a termination of employment or a change in control

of Kroger, as described below. Our pension plans and nonqualified deferred compensation plan also

provide for certain payments and benefits to participants in the event of a termination of employment, as

described above in the Pension Benefits section and the Nonqualified Deferred Compensation section,

respectively.

A “change in control” under KEPP, and our equity and non-equity incentive awards occurs if:

• any person or entity (excluding Kroger’s employee benefit plans) acquires 20% or more of the voting

power of Kroger;

• a merger, consolidation, share exchange, division, or other reorganization or transaction with Kroger

results in Kroger’s voting securities existing prior to that event representing less than 60% of the

combined voting power immediately after the event;

• Kroger’s shareholders approve a plan of complete liquidation or winding up of Kroger or an

agreement for the sale or disposition of all or substantially all of Kroger’s assets; or

• during any period of 24 consecutive months, individuals at the beginning of the period who

constituted Kroger’s Board of Directors cease for any reason to constitute at least a majority of the

Board of Directors.

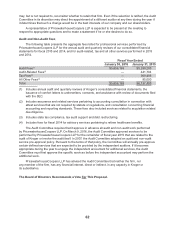

KEPP

KEPP applies to all management employees and administrative support personnel who are not

covered by a collective bargaining agreement, with at least one year of service, and provides severance

benefits when a participant’s employment is terminated actually or constructively within two years

following a change in control of Kroger, including the NEOs. The actual amount is dependent on pay level

and years of service. The NEOs are eligible for the following benefits:

• a lump sum severance payment equal to up to two times the sum of the participant’s annual base

salary and 70% of the greater of the current annual cash bonus potential or the average of the

actual annual cash bonus payments for the prior three years;