Kroger 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

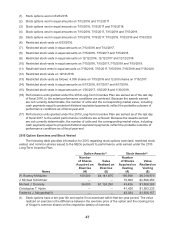

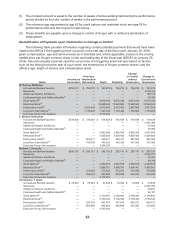

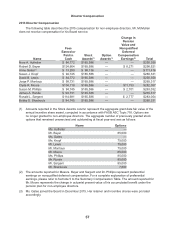

Director Compensation

2015 Director Compensation

The following table describes the 2015 compensation for non-employee directors. Mr. McMullen

does not receive compensation for his Board service.

Name

Fees

Earned or

Paid in

Cash

Stock

Awards(1)

Option

Awards(1)

Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings(2) Total

Nora A. Aufreiter $ 84,772 $165,586 — — $250,358

Robert D. Beyer $124,664 $165,586 — $ 8,271 $298,521

Anne Gates(3) $ 13,280 $ 98,136 — — $ 111,416

Susan J. Kropf $ 94,745 $165,586 — — $260,331

David B. Lewis $ 84,772 $165,586 — — $250,358

Jorge P. Montoya $ 99,731 $165,586 — — $265,317

Clyde R. Moore $104,718 $165,586 — $11,753 $282,057

Susan M. Phillips $ 94,745 $165,586 — $ 2,701 $263,032

James A. Runde $ 99,731 $165,586 — — $265,317

Ronald L. Sargent $ 114,691 $165,586 — $ 2,777 $283,054

Bobby S. Shackouls $ 94,745 $165,586 — — $260,331

(1) Amounts reported in the Stock Awards column represent the aggregate grant date fair value of the

annual incentive share award, computed in accordance with FASB ASC Topic 718. Options are

no longer granted to non-employee directors. The aggregate number of previously granted stock

options that remained unexercised and outstanding at fiscal year-end was as follows:

Name Options

Ms. Aufreiter —

Mr. Beyer 85,000

Ms. Gates —

Ms. Kropf 75,000

Mr. Lewis 75,000

Mr. Montoya 75,000

Mr. Moore 65,000

Ms. Phillips 85,000

Mr. Runde 85,000

Mr. Sargent 85,000

Mr. Shackouls 7,800

(2) The amounts reported for Messrs. Beyer and Sargent and Dr. Phillips represent preferential

earnings on nonqualified deferred compensation. For a complete explanation of preferential

earnings, please refer to footnote 5 to the Summary Compensation Table. The amount reported for

Mr. Moore represents the change in actuarial present value of his accumulated benefit under the

pension plan for non-employee directors.

(3) Ms. Gates joined the Board in December 2015. Her retainer and incentive shares were prorated

accordingly.