Kroger 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-47

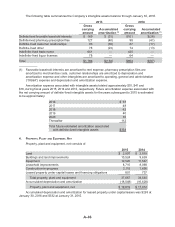

Approximately $264 and $260, net book value, of property, plant and equipment collateralized

certain mortgages at January 30, 2016 and January 31, 2015, respectively.

5. TAXES BASED ON INCOME

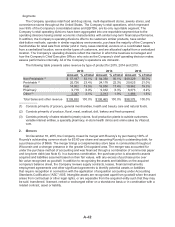

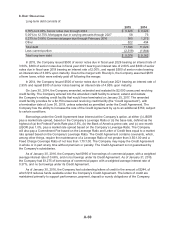

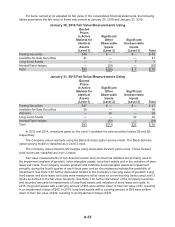

The provision for taxes based on income consists of:

2015 2014 2013

Federal

Current $ 723 $847 $638

Deferred 266 (15) 81

Subtotal federal 989 832 719

State and local

Current 37 59 42

Deferred 19 11 (10)

Subtotal state and local 56 70 32

Total $1,045 $902 $751

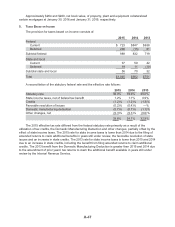

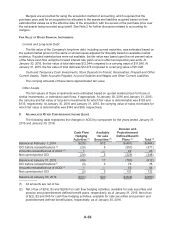

A reconciliation of the statutory federal rate and the effective rate follows:

2015 2014 2013

Statutory rate 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit 1.2% 1.7% 0.9%

Credits (1.2)% (1.2)% (1.3)%

Favorable resolution of issues (0.2)% (0.4)% —%

Domestic manufacturing deduction (0.7)% (0.7)% (1.1)%

Other changes, net (0.3)% (0.3)% (0.6)%

33.8% 34.1% 32.9%

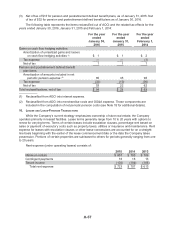

The 2015 effective tax rate differed from the federal statutory rate primarily as a result of the

utilization of tax credits, the Domestic Manufacturing Deduction and other changes, partially offset by the

effect of state income taxes. The 2015 rate for state income taxes is lower than 2014 due to the filing of

amended returns to claim additional benefits in years still under review, the favorable resolution of state

issues and an increase in state credits. The 2013 rate for state income taxes is lower than 2015 and 2014

due to an increase in state credits, including the benefit from filing amended returns to claim additional

credits. The 2013 benefit from the Domestic Manufacturing Deduction is greater than 2015 and 2014 due

to the amendment of prior years’ tax returns to claim the additional benefit available in years still under

review by the Internal Revenue Service.