Kroger 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

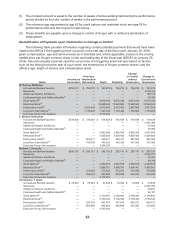

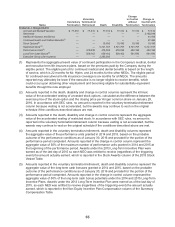

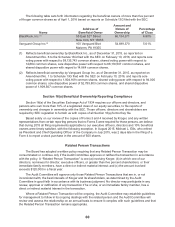

The following table sets forth information regarding the beneficial owners of more than five percent

of Kroger common shares as of April 1, 2016 based on reports on Schedule 13G filed with the SEC.

Name

Address of

Beneficial Owner

Amount and

Nature of

Ownership

Percentage

of Class

BlackRock, Inc.(1) 55 East 52nd Street 66,134,371 6.80%

New York, NY 10055

Vanguard Group Inc.(2) 100 Vanguard Blvd 54,699,370 5.61%

Malvern, PA 19355

(1) Reflects beneficial ownership by BlackRock Inc., as of December 31, 2015, as reported on

Amendment No. 6 to the Schedule 13G filed with the SEC on February 10, 2016, and reports sole

voting power with respect to 58,135,743 common shares, shared voting power with respect to

14,864 common shares, sole dispositive power with respect to 66,119,507 common shares, and

shared dispositive power with regard to 14,864 common shares.

(2) Reflects beneficial ownership by Vanguard Group Inc. as of December 31, 2015, as reported on

Amendment No. 1 to Schedule 13G filed with the SEC on February 10, 2016, and reports sole

voting power with respect to 1,804,169 common shares, shared voting power with respect to 94,000

common shares, sole dispositive power of 52,789,803 common shares, and shared dispositive

power of 1,909,567 common shares.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and

persons who own more than 10% of a registered class of our equity securities, to file reports of

ownership and changes in ownership with the SEC. Those officers, directors and shareholders are

required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of Forms 3 and 4 received by Kroger, and any written

representations from certain reporting persons that no Forms 5 were required for those persons, we believe

that during 2015 all filing requirements applicable to our executive officers, directors and 10% beneficial

owners were timely satisfied, with the following exception. In August 2015, Michael L. Ellis, who retired

as President and Chief Operating Officer of the Company in July 2015, was 2 days late in the filing of a

Form 4 to report a stock purchase in the amount of 500 shares.

Related Person Transactions

The Board has adopted a written policy requiring that any Related Person Transaction may be

consummated or continue only if the Audit Committee approves or ratifies the transaction in accordance

with the policy. A “Related Person Transaction” is one (a) involving Kroger, (b) in which one of our

directors, nominees for director, executive officers, or greater than five percent shareholders, or their

immediate family members, have a direct or indirect material interest; and (c) the amount involved

exceeds $120,000 in a fiscal year.

The Audit Committee will approve only those Related Person Transactions that are in, or not

inconsistent with, the best interests of Kroger and its shareholders, as determined by the Audit

Committee in good faith in accordance with its business judgment. No director may participate in any

review, approval or ratification of any transaction if he or she, or an immediate family member, has a

direct or indirect material interest in the transaction.

Where a Related Person Transaction will be ongoing, the Audit Committee may establish guidelines

for management to follow in its ongoing dealings with the related person and the Audit Committee will

review and assess the relationship on an annual basis to ensure it complies with such guidelines and that

the Related Person Transaction remains appropriate.