Kroger 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-9

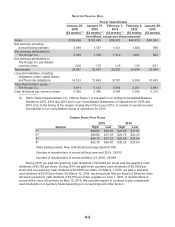

Net Earnings

Net earnings totaled $2.0 billion in 2015, $1.7 billion in 2014 and $1.5 billion in 2013. Net earnings

improved in 2015, compared to net earnings in 2014, due to an increase in operating profit, partially

offset by an increase in income tax expense. Operating profit increased in 2015, compared to 2014,

primarily due to an increase in first-in, first-out (“FIFO”) non-fuel operating profit, lower charges for total

contributions to The Kroger Co. Foundation, UFCW Consolidated Pension Plan, the charge related

to the 2014 Multi-Employer Pension Plan Obligation and a lower LIFO charge which was $28 million

(pre-tax), compared to a LIFO charge of $147 million (pre-tax) in 2014, partially offset by a decrease in

fuel operating profit and continued investments in lower prices for our customers. The decrease in fuel

operating profit was primarily due to a decrease in fuel margin per gallon to $0.17 in 2015, compared to

$0.19 in 2014, partially offset by an increase in fuel gallons sold. Continued investments in lower prices

for our customers includes our pharmacy department, which experienced high levels of inflation that were

not fully passed on to the customer in 2015. Net earnings improved in 2014, compared to net earnings

in 2013, due to an increase in operating profit, partially offset by increases in interest and income tax

expense. Operating profit increased in 2014, compared to 2013, primarily due to an increase in FIFO non-

fuel operating profit, excluding Harris Teeter, the effect of our merger with Harris Teeter and an increase

in fuel operating profit, partially offset by continued investments in lower prices for our customers, the

2014 Contributions, the charge related to the 2014 Multi-Employer Pension Plan Obligation and a higher

LIFO charge which was $147 million (pre-tax), compared to a LIFO charge of $52 million (pre-tax) in

2013.

The net earnings for 2015 do not include any non-GAAP adjustments. The net earnings for 2014

include a net charge of $39 million, after tax, related to the 2014 Adjusted Items. The net earnings

for 2013 include a net benefit of $23 million, after tax, related to the 2013 Adjusted Items. Excluding

these benefits and charges for Adjusted Items for 2014 and 2013, adjusted net earnings were $2.0

billion in 2015, $1.8 billion in 2014 and $1.5 billion in 2013. 2015 net earnings improved, compared to

adjusted net earnings in 2014, due to an increase in FIFO non-fuel operating profit, lower charges for

total contributions to The Kroger Co. Foundation and UFCW Consolidated Pension Plan and a lower

LIFO charge which was $28 million (pre-tax), compared to a LIFO charge of $147 million (pre-tax) in

2014, partially offset by continued investments in lower prices for our customers, a decrease in fuel

operating profit and an increase in income tax expense. Continued investments in lower prices for our

customers includes our pharmacy department, which experienced high levels of inflation that were not

fully passed on to the customer in 2015. 2014 adjusted net earnings improved, compared to adjusted net

earnings in 2013, due to an increase in FIFO non-fuel operating profit, excluding Harris Teeter, the effect

of our merger with Harris Teeter and an increase in fuel operating profit, partially offset by continued

investments in lower prices for our customers, the 2014 Contributions, increases in interest and income

tax expense and a higher LIFO charge which was $147 million (pre-tax), compared to a LIFO charge of

$52 million (pre-tax) in 2013.

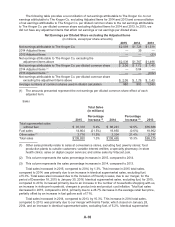

Net earnings per diluted share totaled $2.06 in 2015, $1.72 in 2014 and $1.45 in 2013. Net earnings

per diluted share in 2015, compared to 2014, increased primarily due to fewer shares outstanding as a

result of the repurchase of Kroger common shares and an increase in net earnings. Net earnings per

diluted share in 2014, compared to 2013, increased primarily due to fewer shares outstanding as a result

of the repurchase of Kroger common shares and an increase in net earnings.

There were no adjustment items in 2015, but excluding the 2014 and 2013 Adjusted Items, adjusted

net earnings per diluted share totaled $1.76 in 2014 and $1.43 in 2013. Net earnings per diluted share

in 2015, compared to adjusted net earnings per diluted share in 2014, increased primarily due to fewer

shares outstanding as a result of the repurchase of Kroger common shares and an increase in adjusted

net earnings. Adjusted net earnings per diluted share in 2014, compared to adjusted net earnings per

diluted share in 2013, increased primarily due to fewer shares outstanding as a result of the repurchase

of Kroger common shares and an increase in adjusted net earnings.