Kroger 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-49

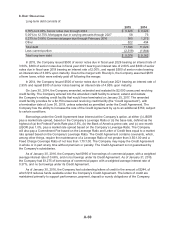

At January 30, 2016, the Company had state credit carryforwards of $65, most of which expire

from 2016 through 2027. The utilization of certain of the Company’s credits may be limited in a given

year. Further, based on the analysis described below, the Company has recorded a valuation allowance

against some of the deferred tax assets resulting from its state credits.

At January 30, 2016, the Company had federal net operating loss carryforwards of $62. These net

operating loss carryforwards expire from 2030 through 2034. The utilization of certain of the Company’s

federal net operating loss carryforwards may be limited in a given year. Further, based on the analysis

described below, the Company has not recorded a valuation allowance against the deferred tax assets

resulting from its federal net operating losses.

The Company regularly reviews all deferred tax assets on a tax filer and jurisdictional basis to

estimate whether these assets are more likely than not to be realized based on all available evidence.

This evidence includes historical taxable income, projected future taxable income, the expected timing

of the reversal of existing temporary differences and the implementation of tax planning strategies.

Projected future taxable income is based on expected results and assumptions as to the jurisdiction in

which the income will be earned. The expected timing of the reversals of existing temporary differences

is based on current tax law and the Company’s tax methods of accounting. Unless deferred tax assets

are more likely than not to be realized, a valuation allowance is established to reduce the carrying value

of the deferred tax asset until such time that realization becomes more likely than not. Increases and

decreases in these valuation allowances are included in “Income tax expense” in the Consolidated

Statements of Operations.

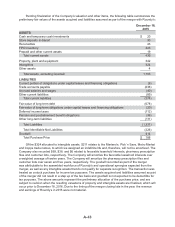

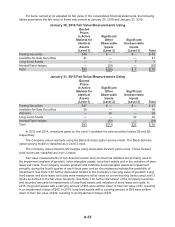

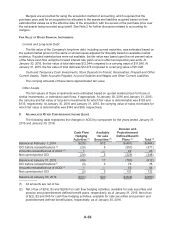

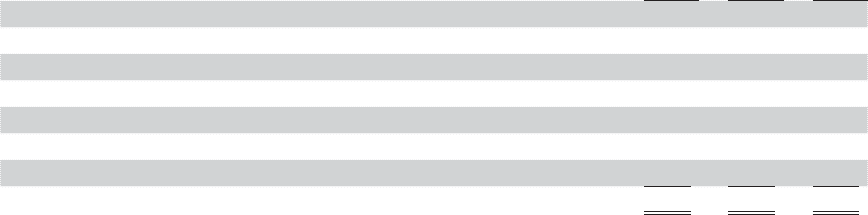

A reconciliation of the beginning and ending amount of unrecognized tax benefits, including

positions impacting only the timing of tax benefits, is as follows:

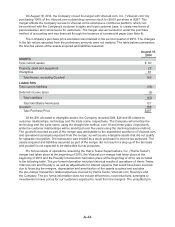

2015 2014 2013

Beginning balance $246 $325 $299

Additions based on tax positions related to the current year 11 17 23

Reductions based on tax positions related to the current year (11) (6) (10)

Additions for tax positions of prior years 4 9 17

Reductions for tax positions of prior years (27) (36) (4)

Settlements (17) (63) —

Lapse of statute (2) — —

Ending balance $204 $246 $325

The Company does not anticipate that changes in the amount of unrecognized tax benefits over the

next twelve months will have a significant impact on its results of operations or financial position.

As of January 30, 2016, January 31, 2015 and February 1, 2014, the amount of unrecognized tax

benefits that, if recognized, would impact the effective tax rate was $83, $90 and $98, respectively.

To the extent interest and penalties would be assessed by taxing authorities on any underpayment

of income tax, such amounts have been accrued and classified as a component of income tax expense.

During the years ended January 30, 2016, January 31, 2015 and February 1, 2014, the Company

recognized approximately $(5), $3 and $10, respectively, in interest and penalties (recoveries). The

Company had accrued approximately $25, $30 and $41 for the payment of interest and penalties as of

January 30, 2016, January 31, 2015 and February 1, 2014, respectively.

As of January 31, 2015, the Internal Revenue Service had concluded its examination of our 2010

and 2011 federal tax returns and is currently auditing tax years 2012 and 2013. The 2012 and 2013 audits

are expected to be completed in 2016.