Kroger 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

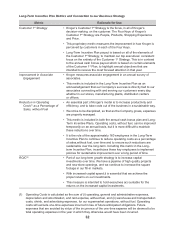

42

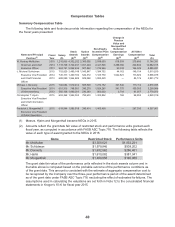

(5) For 2015, the amounts reported consist of the aggregate change in the actuarial present value of

the NEO’s accumulated benefit under a defined benefit pension plan (including supplemental plans),

which applies to all eligible NEOs, and preferential earnings on nonqualified deferred compensation,

which applies to Messrs. McMullen, Donnelly and Hjelm:

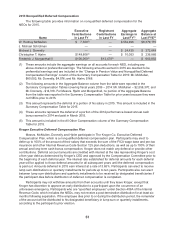

Name

Change in

Pension Value

Preferential Earnings on Nonqualified

Deferred Compensation

Mr. McMullen $ 537,941 $80,092

Mr. Schlotman $ 44,163 N/A

Mr. Donnelly $ 316,969 $ 4,576

Mr. Hjelm $ (1,142) $ 168

Mr. Morganthall $(429,556) N/A

The change in value of the accumulated pension benefit for each of Messrs. Hjelm and Morganthall

are not included in the table because the value decreased.

Amounts reported for 2015 and 2014 include the change in the actuarial present value of

accumulated pension benefits and preferential earnings on nonqualified deferred compensation.

Amounts reported for 2013 include only preferential earnings on nonqualified deferred

compensation because the changes in pension value were negative, which are not required to be

reported in the table in accordance with SEC rules. Pension values may fluctuate significantly from

year to year depending on a number of factors, including age, years of service, average annual

earnings and the assumptions used to determine the present value, such as the discount rate. The

change in the actuarial present value of accumulated pension benefits for 2014 was significantly

greater than 2013 primarily due to a lower discount rate and revised mortality assumptions. The

change in the actuarial present value of accumulated pension benefits for 2015 is primarily due to

a lower discount rate. Please see the Pension Benefits section for further information regarding the

assumptions used in calculating pension benefits.

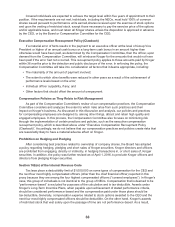

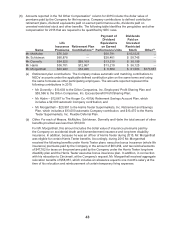

Messrs. McMullen, Donnelly and Hjelm participate in Kroger’s nonqualified deferred compensation

plan. Under the plan, deferred compensation earns interest at a rate representing Kroger’s cost of

ten-year debt, as determined by the CEO and approved by the Compensation Committee prior to

the beginning of each deferral year. For each participant, a separate deferral account is created

each year and the interest rate established for that year is applied to that deferral account until the

deferred compensation is paid out. If the interest rate established by Kroger for a particular year

exceeds 120% of the applicable federal long-term interest rate that corresponds most closely to

the plan rate, the amount by which the plan rate exceeds 120% of the corresponding federal rate

is deemed to be above-market or preferential. In thirteen of the twenty-two years in which at least

one NEO deferred compensation, the rate set under the plan for that year exceeds 120% of the

corresponding federal rate. For each of the deferral accounts in which the plan rate is deemed to be

above-market, Kroger calculates the amount by which the actual annual earnings on the account

exceed what the annual earnings would have been if the account earned interest at 120% of the

corresponding federal rate, and discloses those amounts as preferential earnings. Amounts deferred

in 2015 earn interest at a rate lower than 120% of the corresponding federal rate; accordingly there

are no preferential earnings on these amounts. In 2015, Mr. Morganthall participated in the Harris

Teeter Supermarkets, Inc.Flexible Deferral Plan (the “HT Flexible Deferral Plan”), which does not

provide above-market or preferential earnings on deferred compensation.