Kroger 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

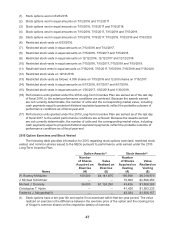

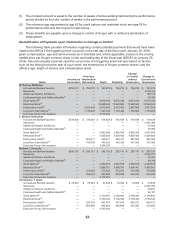

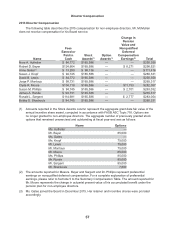

Name

Involuntary

Termination

Voluntary

Termination/

Retirement Death Disability

Change

in Control

without

Termination

Change in

Control with

Termination

Frederick J. Morganthall II

Accrued and Banked Vacation $ 77,310 $ 77,310 $ 77,310 $ 77,310 $ 77,310 $ 77,310

Severance — — — — — 2,180,016

Additional Vacation and Bonus — — — — — 41,443

Continued Health and Welfare Benefits(1) — — — — — 27,484

Stock Options(2) — — 19,180 19,180 19,180 19,180

Restricted Stock(3) — — 5,721,797 5,721,797 5,721,797 5,721,797

Performance Units(4) — 478,038 478,038 478,038 452,195 452,195

Long-Term Cash Bonus(5) — 559,162 559,162 559,162 561,930 561,930

Executive Group Life Insurance — — 2,295,000 — — —

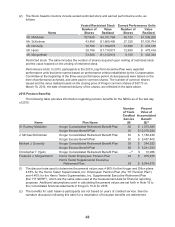

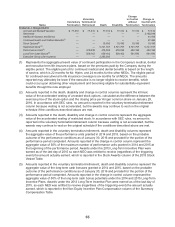

(1) Represents the aggregate present value of continued participation in the Company’s medical, dental

and executive term life insurance plans, based on the premiums paid by the Company during the

eligible period. The eligible period for continued medical and dental benefits is based on the length

of service, which is 22 months for Mr. Hjelm, and 24 months for the other NEOs. The eligible period

for continued executive term life insurance coverage is six months for all NEOs. The amounts

reported may ultimately be lower if the executive is no longer eligible to receive benefits, which

could occur upon obtaining other employment and becoming eligible for substantially equivalent

benefits through the new employer.

(2) Amounts reported in the death, disability and change in control columns represent the intrinsic

value of the accelerated vesting of unvested stock options, calculated as the difference between the

exercise price of the stock option and the closing price per Kroger common share on January 29,

2016. In accordance with SEC rules, no amount is reported in the voluntary termination/retirement

column because vesting is not accelerated, but the awards may continue to vest on the original

schedule if the conditions described above are met.

(3) Amounts reported in the death, disability and change in control columns represent the aggregate

value of the accelerated vesting of restricted stock. In accordance with SEC rules, no amount is

reported in the voluntary termination/retirement column because vesting is not accelerated, but the

awards may continue to vest on the original schedule if the conditions described above are met.

(4) Amounts reported in the voluntary termination/retirement, death and disability columns represent

the aggregate value of the performance units granted in 2014 and 2015, based on the probable

outcome of the performance conditions as of January 30, 2016 and prorated for the portion of the

performance period completed. Amounts reported in the change in control column represent the

aggregate value of 50% of the maximum number of performance units granted in 2014 and 2015 at

the beginning of the performance period. Awards under the 2013 Long-Term Incentive Plan were

earned as of the last day of 2015 so each NEO was entitled to receive (regardless of the triggering

event) the amount actually earned, which is reported in the Stock Awards column of the 2015 Stock

Vested Table.

(5) Amounts reported in the voluntary termination/retirement, death and disability columns represent the

aggregate value of the long-term cash bonuses granted in 2014 and 2015, based on the probable

outcome of the performance conditions as of January 30, 2016 and prorated for the portion of the

performance period completed. Amounts reported in the change in control column represent the

aggregate value of 50% of the long-term cash bonus potentials under the 2014 and 2015 Long-Term

Incentive Plans. Awards under the 2013 Long-Term Incentive Plan were earned as of the last day of

2015, so each NEO was entitled to receive (regardless of the triggering event) the amount actually

earned, which is reported in the Non-Equity Incentive Plan Compensation column of the Summary

Compensation Table.