Kroger 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

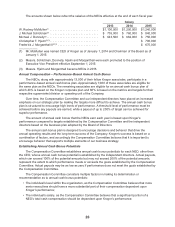

As discussed below under Stock Ownership Guidelines, covered individuals, including the NEOs,

must hold 100% of common shares issued pursuant to performance units earned, the shares received

upon the exercise of stock options or upon the vesting of restricted stock, except those necessary to

pay the exercise price of the options and/or applicable taxes, until applicable stock ownership guidelines

are met, unless the disposition is approved in advance by the CEO, or by the Board or Compensation

Committee for the CEO.

Retirement and Other Benefits

Kroger maintains a defined benefit and several defined contribution retirement plans for its

employees. The NEOs participate in one or more of these plans, as well as one or more excess plans

designed to make up the shortfall in retirement benefits created by limitations under the Internal Revenue

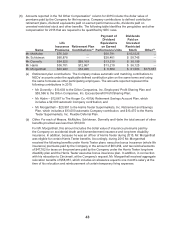

Code on benefits to highly compensated individuals under qualified plans. Additional details regarding

certain retirement benefits available to the NEOs can be found below in the 2015 Pension Benefits Table

and the accompanying narrative description that follows this discussion and analysis.

Kroger also maintains an executive deferred compensation plan in which some of the NEOs

participate. This plan is a nonqualified plan under which participants can elect to defer up to 100% of

their cash compensation each year. Additional details regarding our nonqualified deferred compensation

plans available to the NEOs can be found below in the Nonqualified Deferred Compensation Table and

the accompanying narrative.

Kroger also maintains The Kroger Co. Employee Protection Plan (“KEPP”), which covers all of our

management employees and administrative support personnel who have provided services to Kroger

for at least one year and whose employment is not covered by a collective bargaining agreement. KEPP

provides for severance benefits and extended Kroger-paid health care, as well as the continuation of

other benefits as described in the plan, when an employee is actually or constructively terminated without

cause within two years following a change in control of Kroger (as defined in KEPP). Participants are

entitled to severance pay of up to 24 months’ salary and bonus. The actual amount is dependent upon

pay level and years of service. KEPP can be amended or terminated by the Board at any time prior to a

change in control.

Performance-based long-term cash bonus, performance unit, stock option, and restricted stock

agreements with award recipients provide that those awards “vest,” with 50% of the long-term cash

bonus potential being paid, common shares equal to 50% of the performance units being awarded,

options becoming immediately exercisable, and restrictions on restricted stock lapsing upon a change in

control as described in the grant agreements.

None of the NEOs is party to an employment agreement.

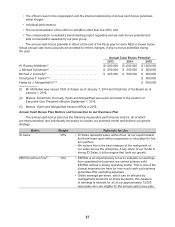

Perquisites

NEOs receive limited perquisites because the Compensation Committee does not believe that it is

necessary for the attraction or retention of management talent to provide the NEOs a substantial amount

of compensation in the form of perquisites. In 2015, the only perquisites available to our NEOs were:

• premiums paid on life insurance policies;

• premiums paid on accidental death and dismemberment insurance; and

• premiums paid on long-term disability insurance policies.

Because he was an officer of Harris Teeter during 2015, Mr. Morganthall also was eligible for the

following Harris Teeter perquisites:

• premiums paid on executive bonus insurance policies; and

• tax reimbursements for the taxes due on insurance premiums paid by Harris Teeter.

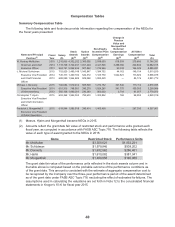

The total amount of perquisites furnished to the NEOs is shown in the Summary Compensation

Table and described in more detail in footnote 6 to that table.