Kroger 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-39

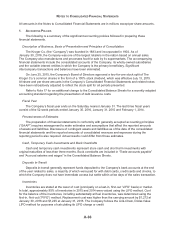

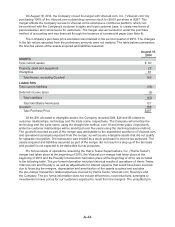

Benefit Plans and Multi-Employer Pension Plans

The Company recognizes the funded status of its retirement plans on the Consolidated Balance

Sheets. Actuarial gains or losses, prior service costs or credits and transition obligations that have not

yet been recognized as part of net periodic benefit cost are required to be recorded as a component of

Accumulated Other Comprehensive Income (“AOCI”). All plans are measured as of the Company’s fiscal

year end.

The determination of the obligation and expense for Company-sponsored pension plans and

other post-retirement benefits is dependent on the selection of assumptions used by actuaries and

the Company in calculating those amounts. Those assumptions are described in Note 15 and include,

among others, the discount rate, the expected long-term rate of return on plan assets, mortality and the

rates of increase in compensation and health care costs. Actual results that differ from the assumptions

are accumulated and amortized over future periods and, therefore, generally affect the recognized

expense and recorded obligation in future periods. While the Company believes that the assumptions

are appropriate, significant differences in actual experience or significant changes in assumptions may

materially affect the pension and other post-retirement obligations and future expense.

The Company also participates in various multi-employer plans for substantially all union

employees. Pension expense for these plans is recognized as contributions are funded. Refer to Note 16

for additional information regarding the Company’s participation in these various multi-employer plans.

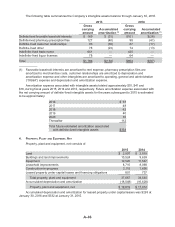

The Company administers and makes contributions to the employee 401(k) retirement savings

accounts. Contributions to the employee 401(k) retirement savings accounts are expensed when

contributed. Refer to Note 15 for additional information regarding the Company’s benefit plans.

Share Based Compensation

The Company accounts for stock options under fair value recognition provisions. Under this method,

the Company recognizes compensation expense for all share-based payments granted. The Company

recognizes share-based compensation expense, net of an estimated forfeiture rate, over the requisite

service period of the award. In addition, the Company records expense for restricted stock awards in

an amount equal to the fair market value of the underlying stock on the grant date of the award, over

the period the awards lapse. Refer to Note 12 for additional information regarding the Company’s stock

based compensation.

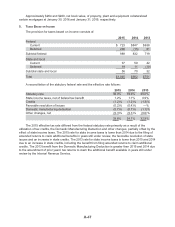

Deferred Income Taxes

Deferred income taxes are recorded to reflect the tax consequences of differences between the

tax basis of assets and liabilities and their financial reporting basis. Refer to Note 5 for the types of

differences that give rise to significant portions of deferred income tax assets and liabilities. Deferred

income taxes are classified as a net current or noncurrent asset or liability based on the classification

of the related asset or liability for financial reporting purposes. A deferred tax asset or liability that is not

related to an asset or liability for financial reporting is classified according to the expected reversal date.

Uncertain Tax Positions

The Company reviews the tax positions taken or expected to be taken on tax returns to determine

whether and to what extent a benefit can be recognized in its consolidated financial statements. Refer

to Note 5 for the amount of unrecognized tax benefits and other related disclosures related to uncertain

tax positions.