Kroger 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-75

In September 2015, the FASB issued ASU 2015-16, “Business Combinations (Topic 805):

Simplifying the Accounting for Measurement-Period Adjustments.” This amendment eliminates the

requirement to retrospectively account for adjustments made to provisional amounts recognized in a

business combination. This guidance will be effective for the Company in its fiscal year ending January

28, 2017. The implementation of this amendment is not expected to have a significant effect on the

Company’s Consolidated Financial Statements.

In November 2015, the FASB issued ASU 2015-17, “Income Taxes (Topic 740): Balance Sheet

Classification of Deferred Taxes.” This amendment requires deferred tax liabilities and assets be

classified as noncurrent in a classified statement of financial position. This guidance will be effective

for the fiscal year ending January 28, 2017. Early adoption is permitted. The implementation of this

amendment will not have an effect on the Company’s Consolidated Statements of Operations and will not

have a significant effect on the Company’s Consolidated Balance Sheets.

In February 2016, the FASB issued ASU 2016-02, “Leases”, which provides guidance for the

recognition of lease agreements. The standard’s core principle is that a company will now recognize most

leases on its balance sheet as lease liabilities with corresponding right-of-use assets. This guidance

will be effective in the first quarter of fiscal year ending February 1, 2020. Early adoption is permitted

currently. The adoption of this ASU will result in a significant increase to the Company’s balance sheet

for lease liabilities and right-of-use assets, and the Company is currently evaluating the other effects of

adoption of this ASU on its Consolidated Financial Statements.

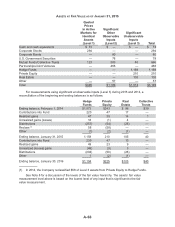

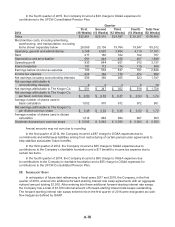

19. QUARTERLY DATA (UNAUDITED)

The two tables that follow reflect the unaudited results of operations for 2015 and 2014.

Quarter

2015

First

(16 Weeks)

Second

(12 Weeks)

Third

(12 Weeks)

Fourth

(12 Weeks)

Total Year

(52 Weeks)

Sales $33,051 $25,539 $25,075 $26,165 $109,830

Merchandise costs, including advertising,

warehousing, and transportation, excluding

items shown separately below 25,760 20,065 19,478 20,193 85,496

Operating, general and administrative 5,354 4,068 4,169 4,355 17,946

Rent 215 155 172 181 723

Depreciation and amortization 620 477 484 508 2,089

Operating profit 1,102 774 772 928 3,576

Interest expense 148 114 107 113 482

Earnings before income tax expense 954 660 665 815 3,094

Income tax expense 330 227 238 250 1,045

Net earnings including noncontrolling interests 624 433 427 565 2,049

Net earnings (loss) attributable to

noncontrolling interests 5 — (1) 6 10

Net earnings attributable to The Kroger Co. $ 619 $ 433 $ 428 $ 559 $ 2,039

Net earnings attributable to The Kroger Co. per

basic common share $ 0.63 $ 0.44 $ 0.44 $ 0.57 $ 2.09

Average number of shares used

in basic calculation 969 963 965 966 966

Net earnings attributable to The Kroger Co.

per diluted common share $ 0.62 $ 0.44 $ 0.43 $ 0.57 $ 2.06

Average number of shares used in

diluted calculation 983 977 979 980 980

Dividends declared per common share $ 0.093 $ 0.105 $ 0.105 $ 0.105 $ 0.408

Annual amounts may not sum due to rounding.

In the third quarter of 2015, the Company incurred a $80 charge to OG&A expenses for

contributions to the UFCW Consolidated Pension Plan.