Kroger 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-69

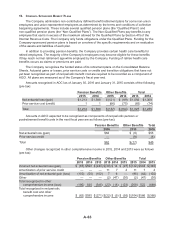

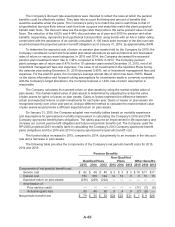

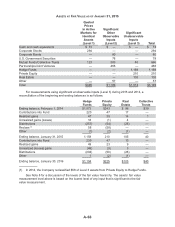

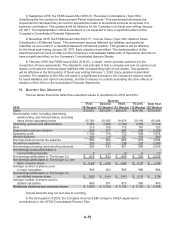

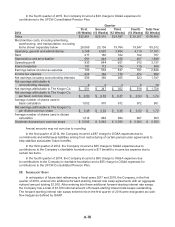

The following is a description of the valuation methods used for the Qualified Plans’ assets

measured at fair value in the above tables:

• Cash and cash equivalents: The carrying value approximates fair value.

• Corporate Stocks: The fair values of these securities are based on observable market quotations

for identical assets and are valued at the closing price reported on the active market on which the

individual securities are traded.

• Corporate Bonds: The fair values of these securities are primarily based on observable market

quotations for similar bonds, valued at the closing price reported on the active market on which the

individual securities are traded. When such quoted prices are not available, the bonds are valued

using a discounted cash flow approach using current yields on similar instruments of issuers with

similar credit ratings, including adjustments for certain risks that may not be observable, such as

credit and liquidity risks.

• U.S. Government Securities: Certain U.S. Government securities are valued at the closing price

reported in the active market in which the security is traded. Other U.S. government securities are

valued based on yields currently available on comparable securities of issuers with similar credit

ratings. When quoted prices are not available for similar securities, the security is valued under a

discounted cash flow approach that maximizes observable inputs, such as current yields of similar

instruments, but includes adjustments for certain risks that may not be observable, such as credit

and liquidity risks.

• Mutual Funds/Collective Trusts: The mutual funds/collective trust funds are public investment

vehicles valued using a Net Asset Value (NAV) provided by the manager of each fund. The

NAV is based on the underlying net assets owned by the fund, divided by the number of shares

outstanding. The NAV’s unit price is quoted on a private market that is not active. However, the NAV

is based on the fair value of the underlying securities within the fund, which are traded on an active

market, and valued at the closing price reported on the active market on which those individual

securities are traded.

• Partnerships/Joint Ventures: These funds consist primarily of U.S. government securities, Corporate

Bonds, Corporate Stocks, and derivatives, which are valued in a manner consistent with these types

of investments, noted above.

• Hedge Funds: Hedge funds are private investment vehicles valued using a Net Asset Value (NAV)

provided by the manager of each fund. The NAV is based on the underlying net assets owned by

the fund, divided by the number of shares outstanding. The NAV’s unit price is quoted on a private

market that is not active. The NAV is based on the fair value of the underlying securities within

the funds, which may be traded on an active market, and valued at the closing price reported on

the active market on which those individual securities are traded. For investments not traded on

an active market, or for which a quoted price is not publicly available, a variety of unobservable

valuation methodologies, including discounted cash flow, market multiple and cost valuation

approaches, are employed by the fund manager to value investments. Fair values of all investments

are adjusted annually, if necessary, based on audits of the Hedge Fund financial statements; such

adjustments are reflected in the fair value of the plan’s assets.