Kroger 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-16

quarter and the ending balance of the fourth quarter, of the last four quarters, and dividing by two.

We use a factor of eight for our total rent as we believe this is a common factor used by our investors,

analysts and rating agencies. ROIC is a non-GAAP financial measure of performance. ROIC should not

be reviewed in isolation or considered as a substitute for our financial results as reported in accordance

with GAAP. ROIC is an important measure used by management to evaluate our investment returns on

capital. Management believes ROIC is a useful metric to investors and analysts because it measures how

effectively we are deploying our assets.

Although ROIC is a relatively standard financial term, numerous methods exist for calculating a

company’s ROIC. As a result, the method used by our management to calculate ROIC may differ from

methods other companies use to calculate their ROIC. We urge you to understand the methods used by

other companies to calculate their ROIC before comparing our ROIC to that of such other companies.

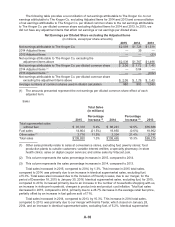

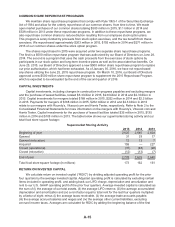

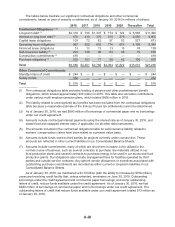

The following table provides a calculation of ROIC for 2015 and 2014. The 2015 calculation of ROIC

excludes the financial position, results and merger costs for the Roundy’s transaction:

January 30,

2016

January 31,

2015

Return on Invested Capital

Numerator

Operating profit $ 3,576 $ 3,137

LIFO charge 28 147

Depreciation and amortization 2,089 1,948

Rent 723 707

Adjustments for pension plan agreements — 87

Other (13) —

Adjusted operating profit $ 6,403 $ 6,026

Denominator

Average total assets $32,197 $29,860

Average taxes receivable (1) (206) (19)

Average LIFO reserve 1,259 1,197

Average accumulated depreciation and amortization 17,441 16,057

Average trade accounts payable (5,390) (4,967)

Average accrued salaries and wages (1,359) (1,221)

Average other current liabilities (2) (3,054) (2,780)

Adjustment for Roundy’s merger (714) —

Rent x 8 5,784 5,656

Average invested capital $45,958 $43,783

Return on Invested Capital 13.93% 13.76%

(1) Taxes receivable were $392 as of January 30, 2016, $20 as of January 31, 2015 and $18 as of

February 1, 2014. The increase in taxes receivable as of January 30, 2016, compared to as of

January 31, 2015, is due to recently issued tangible property regulations. Refer to Note 5 of the

Consolidated Financial Statements for further detail.

(2) Other current liabilities included accrued income taxes of $5 as of January 31, 2015 and $92 as

of February 1, 2014. We did not have any accrued income taxes as of January 30, 2016. Accrued

income taxes are removed from other current liabilities in the calculation of average invested capital.