Kroger 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-71

The risks of participating in multi-employer pension plans are different from the risks of participating

in single-employer pension plans in the following respects:

a. Assets contributed to the multi-employer plan by one employer may be used to provide benefits

to employees of other participating employers.

b. If a participating employer stops contributing to the plan, the unfunded obligations of the

plan allocable to such withdrawing employer may be borne by the remaining participating

employers.

c. If the Company stops participating in some of its multi-employer pension plans, the Company

may be required to pay those plans an amount based on its allocable share of the unfunded

vested benefits of the plan, referred to as a withdrawal liability.

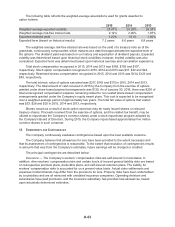

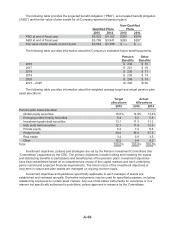

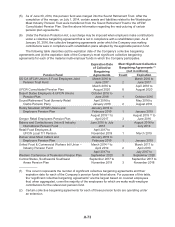

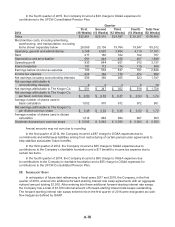

The Company’s participation in multi-employer plans is outlined in the following tables. The

EIN / Pension Plan Number column provides the Employer Identification Number (“EIN”) and the three-

digit pension plan number. The most recent Pension Protection Act Zone Status available in 2015 and

2014 is for the plan’s year-end at December 31, 2014 and December 31, 2013, respectively. Among

other factors, generally, plans in the red zone are less than 65 percent funded, plans in the yellow zone

are less than 80 percent funded and plans in the green zone are at least 80 percent funded. The FIP/

RP Status Pending / Implemented Column indicates plans for which a funding improvement plan (“FIP”)

or a rehabilitation plan (“RP”) is either pending or has been implemented. Unless otherwise noted,

the information for these tables was obtained from the Forms 5500 filed for each plan’s year-end at

December 31, 2014 and December 31, 2013. The multi-employer contributions listed in the table below

are the Company’s multi-employer contributions made in fiscal years 2015, 2014 and 2013.