Kroger 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

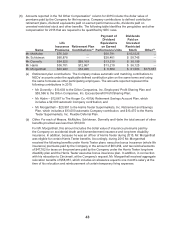

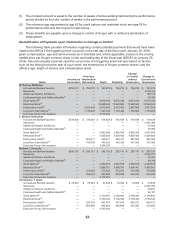

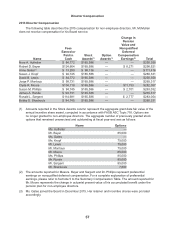

2015 Nonqualified Deferred Compensation

The following table provides information on nonqualified deferred compensation for the

NEOs for 2015.

Name

Executive

Contributions

in Last FY

Registrant

Contributions

in Last FY

Aggregate

Earnings in

Last FY(1)

Aggregate

Balance at

Last FYE(2)

W. Rodney McMullen $ 7,500(3) — $ 532,896 $8,379,170

J. Michael Schlotman — — — —

Michael J. Donnelly — — $ 24,430 $ 372,649

Christopher T. Hjelm $148,808(4) — $ 10,053 $ 236,885

Frederick J. Morganthall II $100,000(4) $13,475(5) — $ 663,852

(1) These amounts include the aggregate earnings on all accounts for each NEO, including any

above-market or preferential earnings. The following amounts earned in 2015 are deemed to be

preferential earnings and are included in the “Change in Pension Value and Nonqualified Deferred

Compensation Earnings” column of the Summary Compensation Table for 2015: Mr. McMullen,

$80,092; Mr. Donnelly, $4,576; and Mr. Hjelm, $168.

(2) The following amounts in the Aggregate Balance column from the table were reported in the

Summary Compensation Tables covering fiscal years 2006 – 2014: Mr. McMullen – $2,558,370; and

Mr. Donnelly - $14,318. For Messrs. Hjelm and Morganthall, no portion of the Aggregate Balance

from the table was reported in the Summary Compensation Table for prior years because they were

not NEOs prior to 2015.

(3) This amount represents the deferral of a portion of his salary in 2015. This amount is included in the

Summary Compensation Table for 2015.

(4) These amounts represent the deferral of a portion of the 2014 performance-based annual cash

bonus earned in 2014 and paid in March 2015.

(5) This amount is included in the All Other Compensation column of the Summary Compensation

Table for 2015.

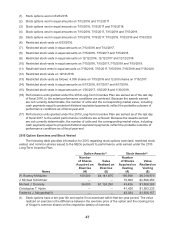

Kroger Executive Deferred Compensation Plan

Messrs. McMullen, Donnelly and Hjelm participate in The Kroger Co. Executive Deferred

Compensation Plan, which is a nonqualified deferred compensation plan. Participants may elect to

defer up to 100% of the amount of their salary that exceeds the sum of the FICA wage base and pre-tax

insurance and other Internal Revenue Code Section 125 plan deductions, as well as up to 100% of their

annual and long-term cash bonus compensation. Kroger does not match any deferral or provide other

contributions. Deferral account amounts are credited with interest at the rate representing Kroger’s cost

of ten-year debt as determined by Kroger’s CEO and approved by the Compensation Committee prior to

the beginning of each deferral year. The interest rate established for deferral amounts for each deferral

year will be applied to those deferral amounts for all subsequent years until the deferred compensation

is paid out. Amounts deferred in 2015 earn interest at a rate of 3.65%. Participants can elect to receive

lump sum distributions or quarterly installments for periods up to ten years. Participants also can elect

between lump sum distributions and quarterly installments to be received by designated beneficiaries if

the participant dies before distribution of deferred compensation is completed.

Participants may not withdraw amounts from their accounts until they leave Kroger, except that

Kroger has discretion to approve an early distribution to a participant upon the occurrence of an

unforeseen emergency. Participants who are “specified employees” under Section 409A of the Internal

Revenue Code, which includes the NEOs, may not receive a post-termination distribution for at least six

months following separation. If the employee dies prior to or during the distribution period, the remainder

of the account will be distributed to his designated beneficiary in lump sum or quarterly installments,

according to the participant’s prior election.