Kroger 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

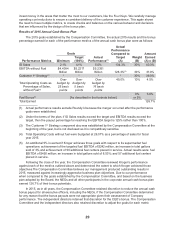

Long-term incentives are structured to be a combination of performance- and time-based

compensation that reflects elements of financial and stock performance to provide both retention value

and alignment with company performance. Long-term cash bonus and performance unit payouts are

contingent on the achievement of certain strategic performance and financial measures and incentivize

recipients to promote long-term value creation and enhance shareholder wealth by supporting the

Company’s long-term strategic goals. Stock options and restricted stock are linked to stock performance

creating alignment between executives and company shareholders. Options have no initial value and

recipients only realize benefits if the value of our stock increases following the date of grant.

A majority of long-term compensation is equity-based (performance units, stock options, and

restricted stock) and is tied to the future value of our common shares, further aligning the interests of

our NEOs with our shareholders. All four components of long-term compensation are intended to focus

executive behaviors on our long-term strategy. Each component is described in more detail below.

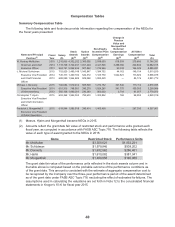

Amounts of long-term compensation awards issued and outstanding for the NEOs are set forth in

the tables that follow this discussion and analysis.

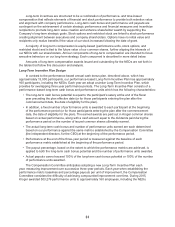

Long-Term Incentive Plan Design

In contrast to the performance-based annual cash bonus plan, described above, which has

approximately 13,000 participants, our performance-based Long-Term Incentive Plan has approximately

160 participants, including the NEOs. Each year we adopt a similar Long-Term Incentive Plan, which

provides for overlapping three year performance periods. The Long-Term Incentive Plan consists of a

performance-based long-term cash bonus and performance units which has the following characteristics:

• The long-term cash bonus potential is equal to the participant’s salary at the end of the fiscal

year preceding the plan effective date (or for those participants entering the plan after the

commencement date, the date of eligibility for the plan).

• In addition, a fixed number of performance units is awarded to each participant at the beginning

of the performance period (or for those participants entering the plan after the commencement

date, the date of eligibility for the plan). The earned awards are paid out in Kroger common shares

based on actual performance, along with a cash amount equal to the dividends paid during the

performance period on the number of issued common shares ultimately earned.

• The actual long-term cash bonus and number of performance units earned are each determined

based on our performance against the same metrics established by the Compensation Committee

(the independent directors, for the CEO) at the beginning of the performance period.

• Performance at the end of the three-year period is measured against the baseline of each

performance metric established at the beginning of the performance period.

• The payout percentage, based on the extent to which the performance metrics are achieved, is

applied to both the long-term cash bonus potential and the number of performance units awarded.

• Actual payouts cannot exceed 100% of the long-term cash bonus potential or 100% of the number

of performance units awarded.

The Compensation Committee anticipates adopting a new Long-Term Incentive Plan each

year, measuring improvement over successive three-year periods. Each year when establishing the

performance metric baselines and percentage payouts per unit of improvement, the Compensation

Committee considers the difficulty of achieving compounded improvement over time. During 2015,

Kroger awarded 503,276 performance units to approximately 160 employees, including the NEOs.