Kroger 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-20

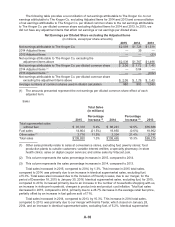

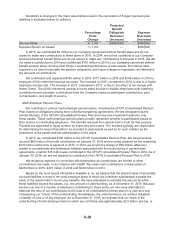

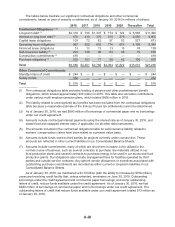

Sensitivity to changes in the major assumptions used in the calculation of Kroger’s pension plan

liabilities is illustrated below (in millions).

Percentage

Point

Change

Projected

Benefit

Obligation

Decrease/

(Increase)

Expense

Decrease/

(Increase)

Discount Rate +/- 1.0% $438/(530) $36/($42)

Expected Return on Assets +/- 1.0% — $38/($38)

In 2015, we contributed $5 million to our Company-sponsored defined benefit plans and do not

expect to make any contributions to these plans in 2016. In 2014, we did not contribute to our Company-

sponsored defined benefit plans and do not expect to make any contributions to this plan in 2015. We did

not make a contribution in 2014 and contributed $100 million in 2013 to our Company-sponsored defined

benefit pension plans. Among other things, investment performance of plan assets, the interest rates

required to be used to calculate the pension obligations, and future changes in legislation, will determine

the amounts of contributions.

We contributed and expensed $196 million in 2015, $177 million in 2014 and $148 million in 2013 to

employee 401(k) retirement savings accounts. The increase in 2015, compared to 2014, is due to a higher

employee savings rate. The increase in 2014, compared to 2013, is due to the effect of our merger with

Harris Teeter. The 401(k) retirement savings account plans provide to eligible employees both matching

contributions and automatic contributions from the Company based on participant contributions, plan

compensation, and length of service.

Multi-Employer Pension Plans

We contribute to various multi-employer pension plans, including the UFCW Consolidated Pension

Plan, based on obligations arising from collective bargaining agreements. We are designated as the

named fiduciary of the UFCW Consolidated Pension Plan and have sole investment authority over

these assets. These multi-employer pension plans provide retirement benefits to participants based on

their service to contributing employers. The benefits are paid from assets held in trust for that purpose.

Trustees are appointed in equal number by employers and unions. The trustees typically are responsible

for determining the level of benefits to be provided to participants as well as for such matters as the

investment of the assets and the administration of the plans.

In 2015, we contributed $190 million to the UFCW Consolidated Pension Plan. We had previously

accrued $60 million of the total contributions at January 31, 2015 and recorded expense for the remaining

$130 million at the time of payment in 2015. In 2014, we incurred a charge of $56 million (after-tax)

related to commitments and withdrawal liabilities associated with the restructuring of pension plan

agreements, of which $15 million was contributed to the UFCW Consolidated Pension Plan in 2014. As of

January 30, 2016, we are not required to contribute to the UFCW Consolidated Pension Plan in 2016.

We recognize expense in connection with these plans as contributions are funded or when

commitments are made, in accordance with GAAP. We made cash contributions to these plans of

$426 million in 2015, $297 million in 2014 and $228 million in 2013.

Based on the most recent information available to us, we believe that the present value of actuarially

accrued liabilities in most of the multi-employer plans to which we contribute substantially exceeds the

value of the assets held in trust to pay benefits. We have attempted to estimate the amount by which

these liabilities exceed the assets, (i.e., the amount of underfunding), as of December 31, 2015. Because

we are only one of a number of employers contributing to these plans, we also have attempted to

estimate the ratio of our contributions to the total of all contributions to these plans in a year as a way

of assessing our “share” of the underfunding. Nonetheless, the underfunding is not a direct obligation

or liability of ours or of any employer. As of December 31, 2015, we estimate that our share of the

underfunding of multi-employer plans to which we contribute was approximately $2.9 billion, pre-tax, or