Kroger 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

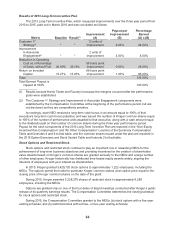

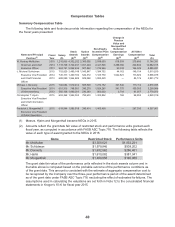

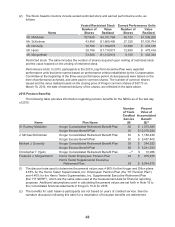

Assuming that the highest level of performance conditions is achieved, the aggregate fair value of

the 2015 performance unit awards at the grant date is as follows:

Name

Value of Performance Units

Assuming Maximum Performance

Mr. McMullen $2,064,462

Mr. Schlotman $1,018,403

Mr. Donnelly $ 572,901

Mr. Hjelm $ 763,881

Mr. Morganthall $ 381,921

(3) These amounts represent the aggregate grant date fair value of option awards computed in

accordance with FASB ASC Topic 718. The assumptions used in calculating the valuations are set

forth in Note 12 to the consolidated financial statements in Kroger’s 10-K for fiscal year 2015.

(4) Non-equity incentive plan compensation earned for 2015 consists of amounts earned under the

2015 performance-based annual cash bonus program and the 2013 Long-Term Incentive Plan. The

amount reported for Mr. Morganthall also includes the 2015 amount earned under the Harris Teeter

Merger Cash Bonus Plan (described below).

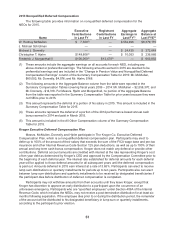

Name Annual Cash Bonus

Long-Term Cash

Bonus

Harris Teeter

Merger Bonus

Mr. McMullen $2,060,093 $939,600 N/A

Mr. Schlotman $ 723,652 $671,100 N/A

Mr. Donnelly $ 723,652 $550,500 N/A

Mr. Hjelm $ 723,652 $579,200 N/A

Mr. Morganthall $ 645,010 $369,083 $439,357

In accordance with the terms of the 2015 performance-based annual cash bonus program, Kroger

paid 126.7% of bonus potentials for the participants, including the NEOs. These amounts were

earned with respect to performance in 2015 and paid in March 2016. Mr. Morganthall’s annual cash

bonus payout was calculated by using the Harris Teeter formula for the 17 weeks he was a Harris

Teeter officer and the Kroger formula for the remainder of the year when he was a Kroger officer.

The long-term cash bonus awarded under the 2013 Long-Term Incentive Plan is a performance-

based bonus plan designed to reward participants for improving the long-term performance

of the Company. The plan covered performance during fiscal years 2013, 2014 and 2015 and

amounts earned under the plan were paid in March 2016. In accordance with the terms of the plan,

participants earned and Kroger paid 100% of long-term cash bonus potentials. The long-term cash

bonus potential equaled the participant’s salary in effect on the last day of fiscal 2012, and for Mr.

Morganthall, the day he became eligible for the plan.

Amounts for Mr. Morganthall also include $439,357 for 2015 performance under The Harris Teeter

Merger Cash Bonus Plan. This plan is a performance-based bonus plan designed to reward

participants for achieving synergies over the three year period following the merger between Harris

Teeter and Kroger, fiscal years 2014, 2015 and 2016. Payouts are made following the end of each

fiscal year of amounts earned based on that year’s performance, subject to a maximum payout over

the three-year period of 200% of the participant’s bonus potential. The bonus potential is equal to

the participant’s salary in effect on the date of the merger. In March 2016, Mr. Morganthall received

$439,357 for 2015 performance.