Kroger 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-37

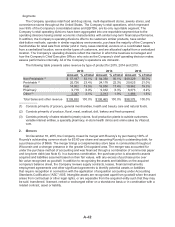

The item-cost method of accounting to determine inventory cost before the LIFO adjustment is

followed for substantially all store inventories at the Company’s supermarket divisions. This method

involves counting each item in inventory, assigning costs to each of these items based on the actual

purchase costs (net of vendor allowances and cash discounts) of each item and recording the cost of

items sold. The item-cost method of accounting allows for more accurate reporting of periodic inventory

balances and enables management to more precisely manage inventory. In addition, substantially all

of the Company’s inventory consists of finished goods and is recorded at actual purchase costs (net of

vendor allowances and cash discounts).

The Company evaluates inventory shortages throughout the year based on actual physical counts

in its facilities. Allowances for inventory shortages are recorded based on the results of these counts to

provide for estimated shortages as of the financial statement date.

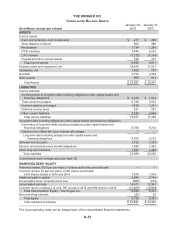

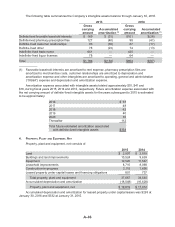

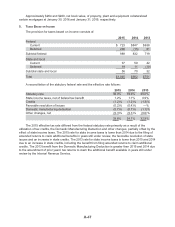

Property, Plant and Equipment

Property, plant and equipment are recorded at cost or, in the case of assets acquired in a business

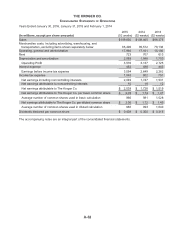

combination, at fair value. Depreciation and amortization expense, which includes the depreciation of

assets recorded under capital leases, is computed principally using the straight-line method over the

estimated useful lives of individual assets. Buildings and land improvements are depreciated based on

lives varying from 10 to 40 years. All new purchases of store equipment are assigned lives varying from

three to nine years. Leasehold improvements are amortized over the shorter of the lease term to which

they relate, which generally varies from four to 25 years, or the useful life of the asset. Food production

plant and distribution center equipment is depreciated over lives varying from three to 15 years.

Information technology assets are generally depreciated over five years. Depreciation and amortization

expense was $2,089 in 2015, $1,948 in 2014 and $1,703 in 2013.

Interest costs on significant projects constructed for the Company’s own use are capitalized as part

of the costs of the newly constructed facilities. Upon retirement or disposal of assets, the cost and related

accumulated depreciation and amortization are removed from the balance sheet and any gain or loss is

reflected in net earnings. Refer to Note 4 for further information regarding the Company’s property, plant

and equipment.

Deferred Rent

The Company recognizes rent holidays, including the time period during which the Company has

access to the property for construction of buildings or improvements and escalating rent provisions on a

straight-line basis over the term of the lease. The deferred amount is included in “Other current liabilities”

and “Other long-term liabilities” on the Company’s Consolidated Balance Sheets.

Goodwill

The Company reviews goodwill for impairment during the fourth quarter of each year, and also upon

the occurrence of a triggering event. The Company performs reviews of each of its operating divisions

and variable interest entities (collectively, “reporting units”) that have goodwill balances. Generally,

fair value is determined using a multiple of earnings, or discounted projected future cash flows, and

is compared to the carrying value of a reporting unit for purposes of identifying potential impairment.

Projected future cash flows are based on management’s knowledge of the current operating environment

and expectations for the future. If potential for impairment is identified, the fair value of a reporting unit

is measured against the fair value of its underlying assets and liabilities, excluding goodwill, to estimate

an implied fair value of the reporting unit’s goodwill. Goodwill impairment is recognized for any excess

of the carrying value of the reporting unit’s goodwill over the implied fair value. Results of the goodwill

impairment reviews performed during 2015, 2014 and 2013 are summarized in Note 3.