Kroger 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

Compensation Discussion and Analysis

Executive Summary

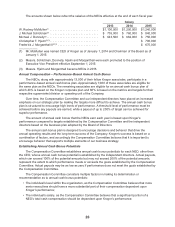

Named Executive Officers

This Compensation Discussion and Analysis provides a discussion and analysis of our

compensation program for our named executive officers (“NEOs”). For the 2015 fiscal year ended

January 30, 2016, the NEOs were:

Name Title

W. Rodney McMullen . . . . . . . . . . . . . . . . . . Chairman and Chief Executive Officer

J. Michael Schlotman . . . . . . . . . . . . . . . . . . Executive Vice President and Chief Financial Officer

Michael J. Donnelly . . . . . . . . . . . . . . . . . . . . Executive Vice President of Merchandising

Christopher T. Hjelm . . . . . . . . . . . . . . . . . . . Executive Vice President and Chief Information Officer

Frederick J. Morganthall II . . . . . . . . . . . . . . . Executive Vice President of Retail Operations

Messrs. Schlotman, Donnelly, Hjelm and Morganthall were each promoted to the position of

Executive Vice President effective September 1, 2015.

Executive Compensation in Context: Our Growth Plan, Financial Strategy and Fiscal Year 2015 Results

Kroger’s growth plan includes four key performance indicators: positive identical supermarket

sales without fuel (“ID Sales”) growth, slightly expanding non-fuel first in, first out (“FIFO”) operating

margin, growing return on invested capital (“ROIC”), and annual market share growth. In 2015, we met or

exceeded our goals for each of these performance indicators:

• ID Sales. ID Sales increased 5.0% from 2014. Through 2015, we have achieved 49 consecutive

quarters of positive ID Sales growth.

• ROIC. Our ROIC for 2015 was 13.93%, compared to 13.76% for 2014, excluding Roundy’s (acquired

in December 2015).

• Non-Fuel FIFO Operating Margin. We exceeded our commitment to slightly expand FIFO operating

margin, excluding fuel and Roundy’s on a rolling four quarters basis.

• Market Share. Our market share grew for an eleventh consecutive year.

Other highlights of the year include:

• Net earnings per diluted share were $2.06.

• We exceeded our long-term, net earnings per diluted share growth rate of 8-11% in 2015.

• We reduced operating costs excluding fuel as a percentage of sales for the eleventh consecutive year.

Also during 2015, we met all of our objectives with regard to our financial strategy:

• Maintain our current investment grade debt rating. Our net total debt to adjusted EBITDA ratio

decreased, even while investing approximately $870 million in our merger with Roundy’s late in

the year.

• Repurchase shares. In 2015, we repurchased $703 million in Kroger common shares.

• Fund the dividend. We returned $385 million to shareholders through our dividend in 2015, and we

increased our dividend for the ninth consecutive year since we reinstated our dividend in 2006.

• Increase capital investments. Our 2015 cash flow generation was strong, allowing us to make

$3.3 billion in capital investments during the year, excluding mergers, acquisitions and purchases of

leased facilities.

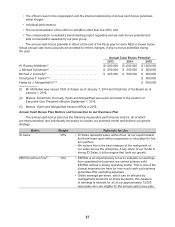

The compensation of our NEOs in 2015 reflects Kroger’s short-term and long-term goals and

outcomes. Total compensation for the year is an indicator of how well Kroger performed compared to

our business plan, reflecting how our compensation program responds to business challenges and

the marketplace.