Kroger 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

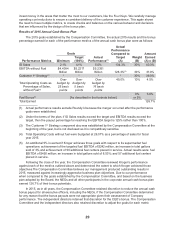

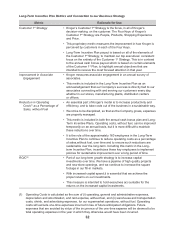

Metric Weight Rationale for Use

Customer 1st Strategy 30% • Kroger’s Customer 1st Strategy is the focus, in all of Kroger’s

decision-making, on the customer. The “Four Keys” of

Kroger’s Customer 1st Strategy are People, Products,

Shopping Experience and Price.

• This proprietary metric measures the improvement in how

Kroger is perceived by customers in each of the Four Keys.

• Annual cash bonus payout is based on certain elements of

the Customer 1st Plan, to highlight annual objectives that are

intended to receive the most focused attention in that year.

Total Operating Costs

as a Percentage of

Sales, without Fuel(2)

10% • An essential part of Kroger’s model is to increase

productivity and efficiency, and to take costs out of the

business in a sustainable way.

• We strive to be disciplined, so that as the Company grows,

expenses are properly managed.

Total of 4 Metrics 100%

Fuel Bonus 5% “Kicker” • An additional 5% is earned if Kroger achieves three goals

with respect to its supermarket fuel operations: targeted fuel

EBITDA, an increase in total gallons sold, and additional

fuel centers placed in service.

• The fuel bonus was added to the annual cash bonus plan

as an incentive to encourage the addition of fuel centers

at a faster rate, while maintaining fuel EBITDA and fuel

gallon growth.

• The fuel bonus of 5% is only available if all three measures

are met. If any of the three fuel goals are not met, no portion

of the fuel bonus is earned.

(1) EBITDA is calculated as operating profit plus depreciation and amortization, excluding fuel and

consolidated variable interest entities.

(2) Total Operating Costs is calculated as the sum of (i) operating, general and administrative expenses,

depreciation and amortization, and rent expense, without fuel, and (ii) warehouse and transportation

costs, shrink, and advertising expenses, for our supermarket operations, without fuel.

The use of these four primary metrics creates checks and balances on the various behaviors and

decisions that impact the long-term success of the Company. The ID Sales, EBITDA without fuel and

Customer 1st Strategy metrics are weighted equally to highlight the need to simultaneously achieve all

three metrics in order to maintain our growth.

We aligned the weighting of ID Sales and EBITDA without fuel metrics to emphasize sales growth

balanced with the focus on profit. Kroger’s business is not sustainable if we merely increase our ID Sales,

but do not have a corresponding increase in earnings. Furthermore, payouts in the ID Sales and EBITDA

without fuel segments are interrelated. Achieving the goal for both the ID Sales and EBITDA without fuel

results in a higher percentage payout on both elements. Achieving the target on one, but not the other will

limit the payout percentage on both.

By supporting the Customer 1st Strategy and the Four Keys, we will better connect with our

customers. Our unique competitive advantage is our ability to deliver on the Four Keys, which are the

items that matter most to our customers, and it is that multi-faceted achievement that we believe drives

our ID Sales growth.

As we strive to achieve our aggressive growth targets, we also continuously aim to reduce our

operating costs as a percentage of sales, without fuel. Productivity improvements and other reductions

in operating costs allow us to reduce costs in areas that do not matter to our customers so that we can