Kroger 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A-70

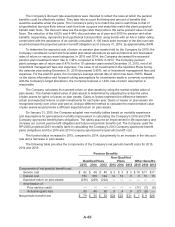

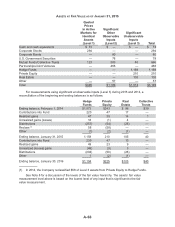

• Private Equity: Private Equity investments are valued based on the fair value of the underlying

securities within the fund, which include investments both traded on an active market and not traded

on an active market. For those investments that are traded on an active market, the values are

based on the closing price reported on the active market on which those individual securities are

traded. For investments not traded on an active market, or for which a quoted price is not publicly

available, a variety of unobservable valuation methodologies, including discounted cash flow, market

multiple and cost valuation approaches, are employed by the fund manager to value investments.

Fair values of all investments are adjusted annually, if necessary, based on audits of the private

equity fund financial statements; such adjustments are reflected in the fair value of the plan’s assets.

• Real Estate: Real estate investments include investments in real estate funds managed by a fund

manager. These investments are valued using a variety of unobservable valuation methodologies,

including discounted cash flow, market multiple and cost valuation approaches.

The methods described above may produce a fair value calculation that may not be indicative of net

realizable value or reflective of future fair values. Furthermore, while the Company believes its valuation

methods are appropriate and consistent with other market participants, the use of different methodologies

or assumptions to determine the fair value of certain financial instruments could result in a different fair

value measurement.

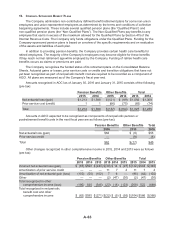

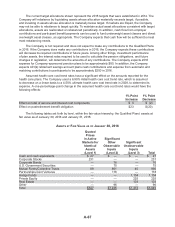

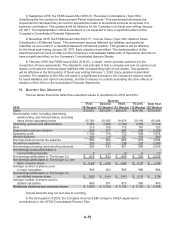

The Company contributed and expensed $196, $177 and $148 to employee 401(k) retirement

savings accounts in 2015, 2014 and 2013, respectively. The 401(k) retirement savings account plans

provide to eligible employees both matching contributions and automatic contributions from the Company

based on participant contributions, compensation as defined by the plan, and length of service.

The Company also administers other defined contribution plans for eligible employees. The cost of

these plans was $5 for 2015, 2014 and 2013.

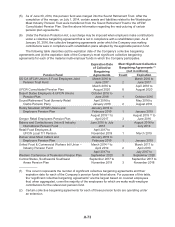

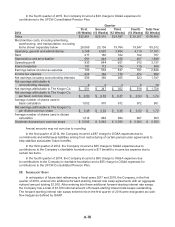

16. MULTI-EMPLOYER PENSION PLANS

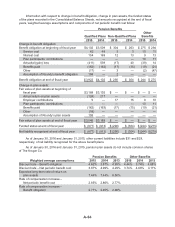

The Company contributes to various multi-employer pension plans, including the UFCW

Consolidated Pension Plan, based on obligations arising from collective bargaining agreements. The

Company is designated as the named fiduciary of the UFCW Consolidated Pension Plan and has sole

investment authority over these assets. These plans provide retirement benefits to participants based on

their service to contributing employers. The benefits are paid from assets held in trust for that purpose.

Trustees are appointed in equal number by employers and unions. The trustees typically are responsible

for determining the level of benefits to be provided to participants as well as for such matters as the

investment of the assets and the administration of the plans.

In 2015, the Company contributed $190 to the UFCW Consolidated Pension Plan. The Company

had previously accrued $60 of the total contributions at January 31, 2015 and recorded expense for the

remaining $130 at the time of payment in 2015.

In 2014, the Company incurred a charge of $56 (after-tax) related to commitments and withdrawal

liabilities associated with the restructuring of pension plan agreements, of which $15 was contributed to

the UFCW Consolidated Pension Plan in 2014.

Refer to Note 19 for additional details on the effect of certain contributions on quarterly results for

2015 and 2014.

The Company recognizes expense in connection with its multi-employer pension plans as

contributions are funded, or when commitments are made. The Company made contributions to multi-

employer funds of $426 in 2015, $297 in 2014 and $228 in 2013.