Kroger 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

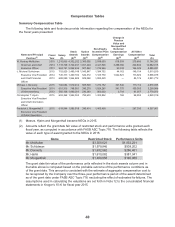

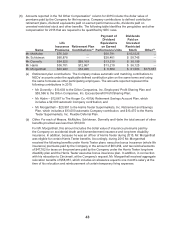

(6) Amounts reported in the “All Other Compensation” column for 2015 include: the dollar value of

premiums paid by the Company for life insurance, Company contributions to defined contribution

retirement plans, dividend equivalents paid on earned performance units, dividends paid on

unvested restricted stock and other benefits. The following table identifies the perquisites and other

compensation for 2015 that are required to be quantified by SEC rules.

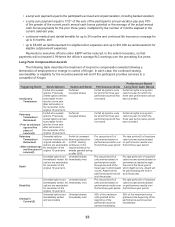

Name

Life

Insurance

Premiums

Retirement Plan

Contributions(a)

Payment of

Dividend

Equivalents

on Earned

Performance Units

Dividends

Paid on

Unvested

Restricted

Stock Other(b)

Mr. McMullen $76,340 —$50,791 $152,525 —

Mr. Schlotman $60,878 —$28,481 $ 58,745 —

Mr. Donnelly $54,525 $69,169 $13,219 $ 38,199 —

Mr. Hjelm $36,781 $12,867 $13,219 $ 36,125 —

Mr. Morganthall $20,940 $34,466 $ 6,689 $ 61,583 $173,657

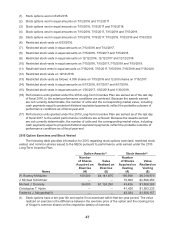

(a) Retirement plan contributions. The Company makes automatic and matching contributions to

NEOs’ accounts under the applicable defined contribution plan on the same terms and using

the same formulas as other participating employees. The amounts reported represent the

following contributions in 2015:

• Mr. Donnelly – $13,603 to the Dillon Companies, Inc. Employees’ Profit Sharing Plan and

$55,566 to the Dillon Companies, Inc. Excess Benefit Profit Sharing Plan;

• Mr. Hjelm – $12,867 to The Kroger Co. 401(k) Retirement Savings Account Plan, which

includes a $2,000 automatic Company contribution; and

• Mr. Morganthall – $20,991 to the Harris Teeter Supermarkets, Inc. Retirement and Savings

Plan, which includes a $13,000 automatic Company contribution, and $13,475 to the Harris

Teeter Supermarkets, Inc. Flexible Deferral Plan.

(b) Other. For each of Messrs. McMullen, Schlotman, Donnelly and Hjelm the total amount of other

benefits provided was less than $10,000.

For Mr. Morganthall, this amount includes the dollar value of insurance premiums paid by

the Company on accidental death and dismemberment insurance and long-term disability

insurance. In addition, because he was an officer of Harris Teeter during 2015, Mr. Morganthall

was eligible for certain Harris Teeter benefits. Accordingly, during 2015 Mr. Morganthall

received the following benefits under Harris Teeter plans: executive bonus insurance (whole life

insurance) premiums paid by the Company in the amount of $63,254, and tax reimbursements

of $47,762 for taxes on the premiums paid by the Company under the Harris Teeter long-term

disability plan and the Harris Teeter executive bonus insurance plan. In addition, in connection

with his relocation to Cincinnati, at the Company’s request, Mr. Morganthall received aggregate

relocation benefits of $58,851, which includes an allowance equal to one month’s salary at the

time of his relocation and reimbursement of certain temporary living expenses.