Kroger 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

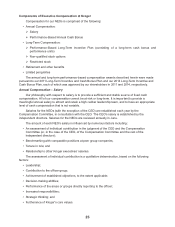

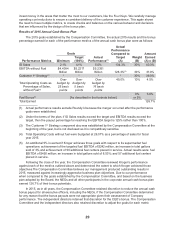

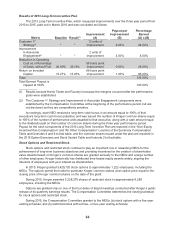

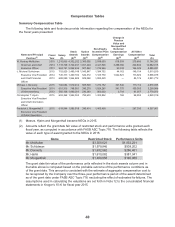

Results of 2013 Long-Term Incentive Plan

The 2013 Long-Term Incentive Plan, which measured improvements over the three year period from

2013 to 2015, paid out in March 2016 and was calculated as follows:

Metric Baseline Result(1)

Improvement

(A)

Payout per

Improvement

(B)

Percentage

Earned

(A) x (B)

Customer 1st

Strategy(2) **

12 units of

improvement 2.00% 24.00%

Improvement

in Associate

Engagement(2) **

2 units of

improvement 4.00% 8.00%

Reduction in Operating

Cost as a Percentage

of Sales, without Fuel 26.69% 26.13%

56 basis point

improvement 0.50% 28.00%

Return on Invested

Capital 13.27% 13.93%

66 basis point

improvement 1.00% 66.00%

Total 126.00%

Total Earned: Payout is

capped at 100% 100.00%

(1) Results exclude Harris Teeter and Roundy’s because the mergers occurred after the performance

goals were established.

(2) The Customer 1st Strategy and Improvement in Associate Engagement components were

established by the Compensation Committee at the beginning of the performance period, but are

not disclosed as they are competitively sensitive.

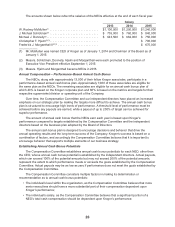

Accordingly, each NEO received a long-term cash bonus in an amount equal to 100% of that

executive’s long-term cash bonus potential, and was issued the number of Kroger common shares equal

to 100% of the number of performance units awarded to that executive, along with a cash amount equal

to the dividends paid on that number of common shares during the three year performance period.

Payout for the cash components of the 2013 Long-Term Incentive Plan are reported in the “Non-Equity

Incentive Plan Compensation” and “All Other Compensation” columns of the Summary Compensation

Table and footnotes 4 and 6 to that table, and the common shares issued under the plan are reported in

the 2015 Option Exercises and Stock Vested Table and footnote 2 to that table.

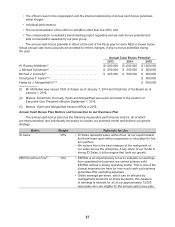

Stock Options and Restricted Stock

Stock options and restricted stock continue to play an important role in rewarding NEOs for the

achievement of long-term business objectives and providing incentives for the creation of shareholder

value.Awards based on Kroger’s common shares are granted annually to the NEOs and a large number

of other employees. Kroger historically has distributed time-based equity awards widely, aligning the

interests of employees with your interest as shareholders.

In 2015, Kroger granted 3,425,720 stock options to approximately 1,222 employees, including the

NEOs. The options permit the holder to purchase Kroger common shares at an option price equal to the

closing price of Kroger common shares on the date of the grant.

During 2015, Kroger awarded 3,228,270 shares of restricted stock to approximately 8,280

employees, including the NEOs.

Options are granted only on one of the four dates of Board meetings conducted after Kroger’s public

release of its quarterly earnings results. The Compensation Committee determines the vesting schedule

for stock options and restricted stock.

During 2015, the Compensation Committee granted to the NEOs: (a) stock options with a five-year

vesting schedule; and (b) restricted stock with a three- or five-year vesting schedule.