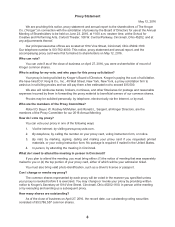

Kroger 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2

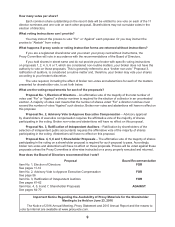

Board of Directors approved a quarterly dividend increase of 13.5%, a two-for-one split of Kroger’s

common shares, and a $500 million share repurchase program. We have delivered double-digit

compound annual growth in our dividend since it was reinstated in 2006, and we continue to expect an

increasing dividend over time. The stock split announced in June both increased liquidity in the trading

of our shares and, importantly, made Kroger’s common shares more accessible to all of our associates.

Kroger’s strong financial position has enabled the company to return approximately $12 billion to

shareholders through share repurchases since January 2000, and approximately $2.6 billion in dividends

since 2006.

Unlike baseball’s Triple Crown, Kroger’s 2015 performance wasn’t a rarity. Kroger is a compelling

investment because of our ability to deliver remarkably consistent results. That consistency can at times

make it easy for our results to be taken for granted. But I can assure you this: we don’t take Kroger’s

success for granted – not for a second. To repeat what I said above, what makes our team of associates

so special is that we are never satisfied with what we’ve already accomplished. Kroger may be 133 years

old, but we are just getting started.

* * *

Improving our Core, Beyond the Core, and Innovation – A Strategy for Long-Term Value Creation

Our growth strategy is designed to deliver consistent sales growth and sustainable shareholder

value for the long-term. We aim to provide a net earnings per diluted share growth rate of 8 – 11% plus an

increasing dividend. Our Board of Directors reviews and approves our strategy annually.

We look at growth initiatives in three categories: our core business, beyond the core, and

innovation. Balance among these three areas is crucial to our strategy. Too many companies over-focus

on innovation in the hopes of discovering the next “big thing”. Balance – the integration of these strategic

elements across our business – is how we’ll continue to win with customers and create sustainable

long-term value for shareholders.

Grow Our Core

Kroger’s core business is strong and growing. Our fundamental strategy, Customer 1st, continues to

drive us forward. Productivity remains a top priority. We are not done taking costs out of the business in

places where our customers don’t notice so that we can reinvest the savings in ways that matter most to

them. Since we launched our Customer 1st strategy in 2004, we have reduced prices annually by more

than $3.6 billion.

We are also narrowing our focus on Friendly & Fresh investments. These initiatives are designed to

accelerate progress on the key factors that customers tell us determine where they shop – a store with

genuinely friendly service, and produce, meat and seafood offerings at the peak of freshness. While it

isn’t as easy to see this type of non-price investment on the balance sheet, they are no less important

than our price investments and remain a priority.

We are investing in markets with growth potential so we can serve more customers every day. In

2015 we merged with Milwaukee-based Roundy’s, Inc. Roundy’s brought to Kroger more than 22,000

talented associates and outstanding Pick ‘n Save, Copps and Metro Market store locations in new

markets in the state of Wisconsin, plus an innovative, urban format called Mariano’s in Chicago. Roundy’s

shares our commitment to putting customers first and we see great potential for future growth together.

Important to our success with mergers is that we don’t need them to meet our long-term earnings per

diluted share growth target of 8 – 11%. This frees us to only pursue deals that are the right fit for our

company and will help create long-term value for shareholders.

We continue to expand our presence in fill-in markets across the country as well. These are markets

where we already operate, yet offer a significant opportunity to grow the business. We are making

incremental capital investments in these markets to grow market share, which will, in turn, improve return

on invested capital.