Kroger 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-60

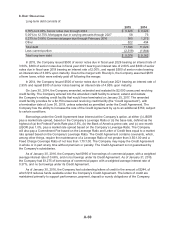

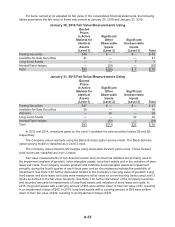

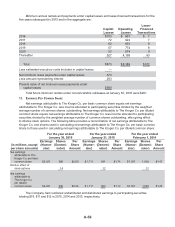

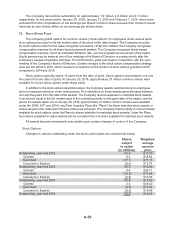

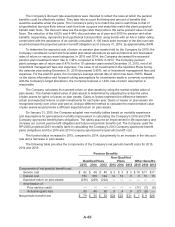

A summary of options outstanding, exercisable and expected to vest at January 30, 2016 follows:

Number of

shares

Weighted-

average

remaining

contractual

life

Weighted-

average

exercise

price

Aggregate

intrinsic

value

(in millions) (in years) (in millions)

Options Outstanding 34.9 6.20 $18.26 719

Options Exercisable 21.4 5.05 $14.24 526

Options Expected to Vest 13.2 8.02 $24.53 189

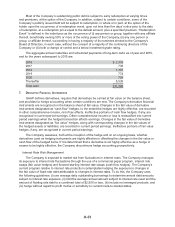

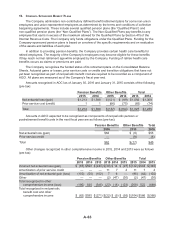

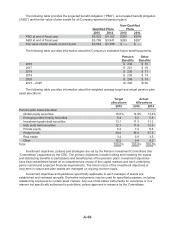

Restricted stock

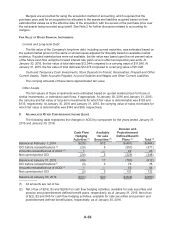

Changes in restricted stock outstanding under the restricted stock plans are summarized below:

Restricted

shares

outstanding

(in millions)

Weighted-

average

grant-date

fair value

Outstanding, year-end 2012 8.6 $ 11.34

Granted 6.3 $18.84

Lapsed (5.1) $11.49

Canceled or Expired (0.2) $13.66

Outstanding, year-end 2013 9.6 $16.16

Granted 6.1 $24.76

Lapsed (5.2) $16.52

Canceled or Expired (0.3) $18.67

Outstanding, year-end 2014 10.2 $21.04

Granted 3.2 $38.34

Lapsed (5.4) $21.49

Canceled or Expired (0.4) $22.80

Outstanding, year-end 2015 7.6 $28.01

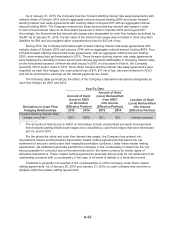

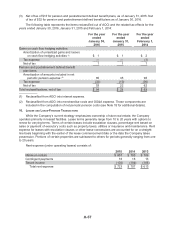

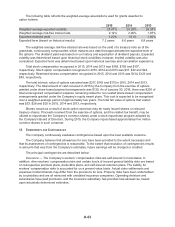

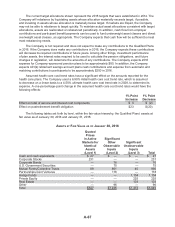

The weighted-average grant date fair value of stock options granted during 2015, 2014 and 2013

was $9.78, $5.98 and $4.49, respectively. The fair value of each stock option grant was estimated on

the date of grant using the Black-Scholes option-pricing model, based on the assumptions shown in the

table below. The Black-Scholes model utilizes accounting judgment and financial estimates, including

the term option holders are expected to retain their stock options before exercising them, the volatility of

the Company’s share price over that expected term, the dividend yield over the term and the number of

awards expected to be forfeited before they vest. Using alternative assumptions in the calculation of fair

value would produce fair values for stock option grants that could be different than those used to record

stock-based compensation expense in the Consolidated Statements of Operations. The increase in the

fair value of the stock options granted during 2015, compared to 2014, resulted primarily from an increase

in the Company’s share price, which decreased the expected dividend yield. The increase in the fair

value of the stock options granted during 2014, compared to 2013, resulted primarily from an increase

in the Company’s share price, which decreased the expected dividend yield, and an increase in the

weighted average risk-free interest rate.