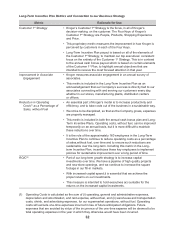

Kroger 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Kroger annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

invest money in the areas that matter the most to our customers, like the Four Keys. We carefully manage

operating cost reductions to ensure a consistent delivery of the customer experience. This again shows

the need to have multiple metrics, to create checks and balances on the various behavior and decisions

that are influenced by the design of the bonus plan.

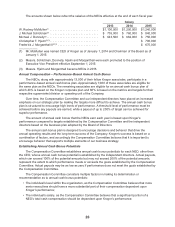

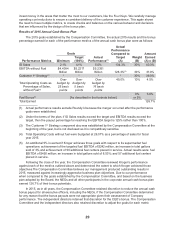

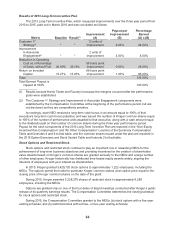

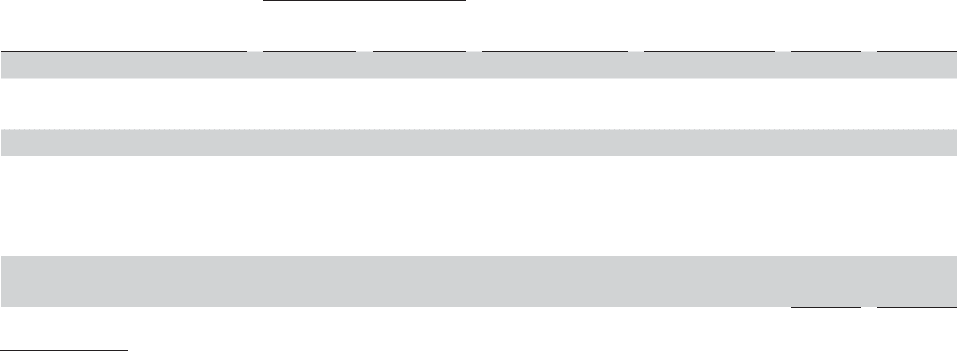

Results of 2015 Annual Cash Bonus Plan

The 2015 goals established by the Compensation Committee, the actual 2015 results and the bonus

percentage earned for each of the performance metrics of the annual cash bonus plan were as follows:

Performance Metrics

Goals

Actual

Performance(1)

Actual

Performance

Compared to

Target

(A)

Weight

(B)

Amount

Earned

(A) x (B)Minimum

Target

(100%)

ID Sales 2.1% 4.1% 5.0% 13 4.3% 30% 40.3%

EBITDA without Fuel $4.4384

Billion

$5.2217

Billion

$5.2351

Billion 126.3%(2) 30% 37.9%

Customer 1st Strategy(3) ** * *30%39.0%

Total Operating Costs as

Percentage of Sales,

without Fuel(4)

Over

budget by

25 basis

points

Over

budget by

5 basis

points

Over

budget by

16 basis

points

45.0% 10% 4.5%

Fuel Bonus(5) [As described in the footnote below]

0%

or 5%

5.0%

Total Earned 126.7%

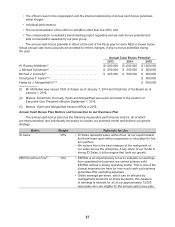

(1) Actual performance results exclude Roundy’s because the merger occurred after the performance

goals were established.

(2) Under the terms of the plan, if ID Sales results exceed the target and EBITDA results exceed the

target, then the payout percentage for reaching the EBITDA target is 125% rather than 100%.

(3) The Customer 1st Strategy component also was established by the Compensation Committee at the

beginning of the year, but is not disclosed as it is competitively sensitive.

(4) Total Operating Costs without fuel were budgeted at 26.07% as a percentage of sales for fiscal

year 2015.

(5) An additional 5% is earned if Kroger achieves three goals with respect to its supermarket fuel

operations: achievement of the targeted fuel EBITDA of $242 million, an increase in total gallons

sold of 3%,and achievement of 50 additional fuel centers placed in service. Actual results were: fuel

EBITDA of $450 million; an increase in total gallons sold of 8.53%; and 57 additional fuel centers

placed in service.

Following the close of the year, the Compensation Committee reviewed Kroger’s performance

against each of the metrics outlined above and determined the extent to which Kroger achieved those

objectives.The Compensation Committee believes our management produced outstanding results in

2015, measured against increasingly aggressive business plan objectives. Due to our performance

when compared to the goals established by the Compensation Committee, and based on the business

plan adopted by the Board, the NEOs and all other participants in the corporate annual cash bonus plan

earned 126.7% of their bonus potentials.

In 2015, as in all years, the Compensation Committee retained discretion to reduce the annual cash

bonus payout for all executive officers, including the NEOs, if the Compensation Committee determined

for any reason that the bonus payouts were not appropriate given their assessment of Company

performance. The independent directors retained that discretion for the CEO’s bonus. The Compensation

Committee and the independent directors also retained discretion to adjust the goals for each metric